金色财经_

Let public goods funding go beyond the circles around us.

In this article, the author uses the concept of 'Circles' as a starting point to reveal layer by layer that we often only follow the circles we are in in our daily lives, often using distance as an excuse to ignore the support for public goods outside of our circles. The article also explores how to extend the mechanism of supporting public goods to a broader field, beyond the circles we directly encounter, and create a truly effective system for supporting public goods. Through such an extension, we can build a 'diverse and civilized scale infrastructure for supporting public goods'.

Main content

The inspiration for this article comes from the work and thought leadership of the organizations mentioned in the article, such as Gitcoin, Optimism, Drips, Superfluid, Hypercerts, as well as Juan Benet and Raymond.

Translator's Preface

In this article, the author uses the concept of 'Circles' as a starting point to reveal layer by layer that we often only follow the circles we are in in our daily lives, often using distance as an excuse to ignore the support for public goods outside of our circles. The article also explores how to extend the mechanism of supporting public goods to a broader field, beyond the circles we directly encounter, and create a truly effective system for supporting public goods. Through such an extension, we can build a 'diverse and civilized scale infrastructure for supporting public goods'.

Main Content

*The inspiration for this article comes from the work and thought leadership of organizations explicitly mentioned in the text (such as Gitcoin, Optimism, Drips, Superfluid, Hypercerts, etc.), as well as multiple conversations with Juan Benet and Raymond Cheng about the characteristics of network capital and private capital.

Every funding ecosystem has core areas as well as important but peripheral areas

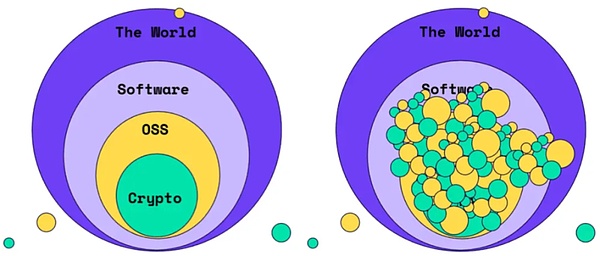

In a blog post in 2021, Gitcoin visualized the concept of nested scopes. The original text described a series of impact funding mechanisms that initially focused on the inner circle ('encryption') and then expanded to the next circle ('Open Source software'), ultimately impacting the whole world.

Owocki's illustrations show the evolution of native funding mechanisms, from "encryption funding encryption" to gradually expanding to impact the entire world

This is a good saying: Start by solving problems near home, then scale up.

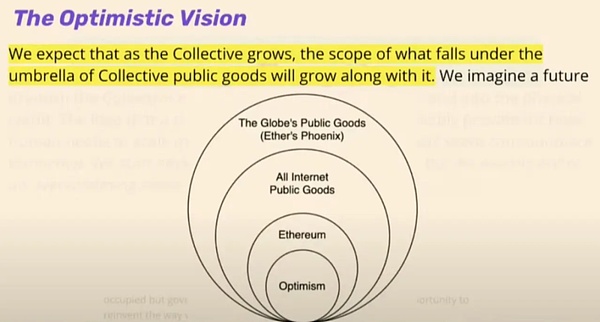

Optimism also uses a similar perspective to explain its vision for retroactive public goods funding.

The vision of Optimism is to expand the scope of its support for public goods through retroactive funding

Optimism is within the Ethereum (ETH) network, which is included in the "all internet public goods". The "all internet public goods" is included in the "global public goods". Each outer domain is a superset of its inner domain.

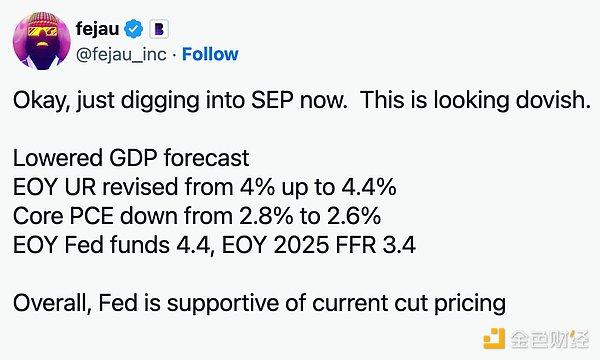

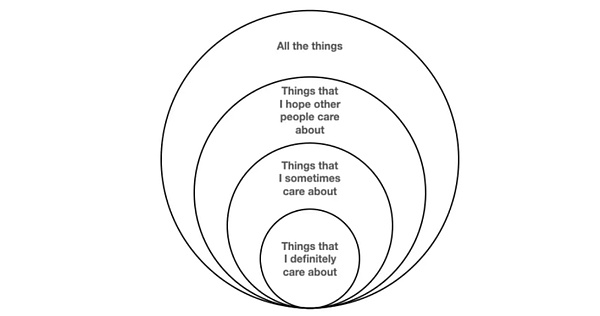

Here is my summary version of the four concentric circle memes.

I care about "everything", but I don't want to worry about how they are funded

Although I personally may not spend time thinking about the biodiversity of deep-sea creatures or the noise pollution in Kolkata, there are indeed many people who care about these issues. Simply being aware of something often shifts it from the realm of 'everything' to 'something I hope others care about.'

Most of us do not have the ability to evaluate important affairs outside our surrounding circles

We are usually able to assess reasonably well the things that are closely related to us in our daily lives. This is our inner circle, or the things we truly care about.

In an organization, a person's inner circle may include your teammates, the projects you closely collaborate on, and the tools you frequently use.

We can also assess some (but maybe not all) of the things that are one degree upstream or downstream in our daily circle. These are things that we sometimes care about.

In the case of a software package, the upstream may be your dependency, and the downstream may be projects dependent on your package. In educational courses, the upstream may include valuable courses or resources that influence the course, while the downstream may include students who recommend the course to friends.

Whether it is software developers or educators, they can seek more upstream research and institutions responsible for these researches, etc. Now we are entering the field of caring about 'everything'.

However, most rational people will stop caring too much about anything at this point. Once we go beyond a certain range, the situation becomes blurred. These are things we hope others care about.

The risk is that we may use distance as an excuse and not support these things, thereby exacerbating the free riding problem.

Although all the affairs within our inner circle rely on the good financial support from the outer circle, which is a fact, it is difficult for those outside of our circle to contribute more than their "Fair Share" of funds to the affairs (although some may attempt to calculate this share). There are valid reasons for this.

First of all, it is very difficult to classify in a large domain. The category of "all Internet public goods" is too broad, so that if you change your perspective, you can advocate that almost anything can be included and worthy of financial support.

Secondly, it is also difficult to incentivize stakeholders to care about matters outside their immediate circle because the impact is so dispersed. I would rather support the entire team I know, rather than an unknown individual from a team I don't know.

Finally, not funding these projects does not have immediate consequences--of course, this is assuming that others continue to fund them and do not withdraw.

So we have encountered a typical free-rider problem.

In addition to the government being able to pay for the costs of long-term public goods projects through printing money, taxation, and issuance of bonds, as a society, we do not have a good mechanism to fund things outside of our most immediate circle. Most capital is used for things that have short-term returns and closer impact.

One way to solve this problem is to focus people on funding things that are close to them (things they can personally evaluate) and to establish mechanisms to continuously push some funds to the periphery.

By the way, this is exactly how private capital flows. We should try to emulate some of the characteristics of private capital.

The reason why the risk investment model of things without short-term/medium-term returns is effective is that private capital is combinable and easy to divide.

There is a model of funding hard tech with a return cycle of 5 to 10 years or more, which is called Venture Capital. Of course, in any given year, the scale of funds flowing into long-term projects is more influenced by the Interest Rate rather than the ultimate value. However, looking at the situation of attracting and mobilizing trillions of dollars of funds over the past few decades, venture capital is a proven effective model.

The reason why the model is effective is largely because venture capital (and other sources of investment capital) are composable and easy to separate.

The so-called combinable, what I mean is that you can accept venture capital at the same time, you can also conduct Initial Public Offering (IPO), obtain bank loans, issuance bonds, and raise capital through more peculiar mechanisms, etc. In fact, this is what people expect. All these financing mechanisms are interoperable.

These mechanisms are well composed, as there are clear commitments regarding who owns what and how cash is allocated. In fact, most companies use a range of financing instruments throughout their lifecycle.

Investment capital is also easily divided. Many people contribute to the same pension fund. Many pension funds (and other investors) invest in the same venture capital fund as limited partners (LPs). Many venture capital funds then invest in the same company. All of these divisional events occur upstream of the company's daily operations.

These features make the flow of private capital in complex network graphs very efficient. If a venture capital-backed company experiences a Liquidity event (such as an Initial Public Offering, acquisition, etc.), profits will be efficiently distributed between the company and its venture capital firms, venture capital firms and their limited partners, pension funds and their retirees, and even transferred from retirees to their children.

This is not the way public goods funds flow on the network. Compared to a large number of irrigation channels, we have relatively few large water towers (such as governments, large foundations, high-net-worth individuals, etc.).

Private Capital VS Public Capital Flow

To be clear, I am not advocating that public goods should receive venture capital funding. I am simply pointing out two important characteristics of private capital that do not correspond to public capital.

How can we enable more public product funds to flow beyond our immediate circle

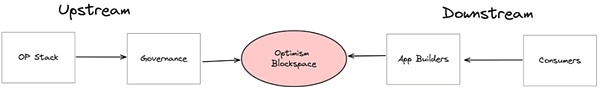

Optimism recently announced a new program for retroactive funding within its ecosystem.

In the previous retroactive funding of Optimism, the scope of projects that could be funded was very wide. In the foreseeable future, the scope of funding will be much narrower, focusing on the upstream and downstream links closer to its value chain.

How does optimism currently consider the impact of upstream and downstream

It is not surprising that there are different feedback opinions about these changes, as many projects that were once within the funding scope are now excluded from the upcoming rounds.

In the newly announced first round of financing, 10 million Tokens were designated for 'on-chain builders', while in the third round of financing, the funding share for on-chain builders disproportionately decreased - out of the available 30 million Tokens, only about 1.5 million were allocated. If these projects were to receive retroactive funding 2-5 times more than the 1.5 million, how would they utilize these funds?

One thing they can do is to allocate some tokens to their own retrospective funding or allocation rounds.

Specifically, if Optimism funds Decentralized Finance applications that drive network volume, these applications can fund front-end, portfolio trackers, and other services that serve the applications they follow.

If Optimism funds the dependencies of the OP stack core, these teams can fund their own dependencies, research contributions, etc.

What if the project uses the retrospective funds they believe they deserve and invests the rest in circulation?

This has already happened in various forms. The Ethereum Attestation Service now has a scholarship program set up for teams building on its protocol. Pokt has just announced its retroactive funding round, integrating all tokens received from Optimism (and Arbitrum) into this round. Even Kiwi News, which received funding below the median in the third round, has implemented its own retroactive funding version for community contributions.

At the same time, Degen Chain has pioneered a more radical concept, giving community members Token allocations and requiring them to give away these Tokens to other community members in the form of 'tips'.

All these experiments are about redirecting public good funding from central pools (such as OP or Degen treasuries) to the edge, expanding their reach.

The next step is to make these commitments clear and verifiable.

One possible implementation is for the project to determine a Floor Value and a Percentage Above The Floor that they are willing to contribute to their own funding pool. For example, my Floor Value may be 50 Tokens, and I am willing to contribute 20% above the Floor Value. If I receive a total of 100 Tokens, I will allocate 10 Tokens (20% of 50 Tokens above the Floor Value) to fund the edges of my network. If I only receive 40 Tokens, I will keep all 40 Tokens.

(By the way, my project also did something similar in the last Optimism funding round.)

In addition to pushing more funds towards the edge, this also serves a critical role in helping public goods projects establish a cost basis. In the long run, for projects that continue to receive less funding than expected, the message conveyed is that they have priced themselves incorrectly or are undervalued in the funding ecosystem.

Projects with surplus will not only be evaluated based on their own influence in subsequent rounds, but also consider the broader impact they create through good capital allocation. Projects that do not want to operate their own funding program can choose to park the surplus in other productive places, such as the Gitcoin matching pool, Protocol Guild, or even choose to destroy the surplus!

In my opinion, the two values determined before the project raises funds should be kept confidential. If a project receives 100 Tokens and donates 10 Tokens, others should not know whether their values are (50, 20%) or (90, 100%).

The final step is to connect these systems together.

The examples of EAS, POKT, and Kiwi News are inspiring, but they all require establishing new projects, and then applying / redeeming / transferring funding tokens to new wallets, and ultimately transferring the funds to new beneficiaries.

Protocols like Drips, Allo, Superfluid, and Hypercerts provide the underlying infrastructure for more composable funding flows - now we need to connect these pipes, just like this pilot project from Geo Web.

The task of this cycle is to create a truly effective public goods funding system. Then, we will start promoting it

In the field of encryption, we are still in the stage of experimenting with various mechanisms to determine funding for which projects and the allocation of funds. Compared to Decentralized Finance (DeFi), the infrastructure for public product funding is still immature, with poor composability and a lack of practical testing.

To take all of this beyond the experimental stage and scale it up, we need to address two issues:

-

The measurement should not only prove the effectiveness of these mechanisms, but also demonstrate that they are more effective than the traditional public goods funding model (see this post [1][2], understand why this is an important issue worth people's efforts, as well as another postAnalysis of the long-term impact of Gitcoin);

-

Clear commitment: Clear commitment on how 'profits' or surplus funds flow to external circles.

In venture capital, there is always an investor behind the investor - ultimately, it could be your grandmother (or more accurately, all of our grandmothers). Each of these investors is motivated to allocate capital efficiently, so as to be trusted in the future and have more control over capital allocation.

For public goods, there is always a closely related group of participants, whether upstream or downstream of your work, you rely on them. But there is currently no commitment to share these surpluses with these entities. Until such commitments become the norm, it will be difficult for public goods funding to surpass our direct circles and achieve scale.

We have not yet reached a stage where we are better than traditional models (picture from Gitcoin White Paper).

I believe that just promising "when we reach a certain scale, we will fund these projects" is not enough. This can easily change goals. Instead, these commitments need to be established early on as foundational elements integrated into the funding mechanism and allocation projects.

I think it's unreasonable to expect the Whale treasury to finance everything. This is the water tower model we use in traditional governments and large foundations.

But if we are still small in scale, the more specific the commitment to provide support for our dependencies, the more it can demonstrate the existence of a public good market, thereby expanding the Total Addressable Market (TAM) and changing the incentive mechanism.

Only in this way can we have something truly worth promoting that can accumulate its own power and create the "diverse, civilized and large-scale public goods funding infrastructure" that we dream of.

- Reward

- like

- Comment

- Share

Witness history +1 Trump pays BTC to treat guests with hamburgers

Trump thus became the first former president in US history to pay with BTC.

Unbeknownst, Trump has once again created a new record: the first former president in U.S. history to make a payment using BTC.

On Wednesday local time, Trump appeared at PubKey, a cryptocurrency-themed bar in Manhattan, New York, shouting and inviting everyone present to eat hamburgers.

The scene shows the bar owner presenting a payment code for Bitcoin. Trump tried to scan the code for payment with a custom iPhone, but quickly got confused by modern technology. Then the bar owner and assistant took over to complete the payment process. Amid cheers at the scene, Trump showed his iconic smile and exclaimed, "History is being made."

(Source: Live broadcast)

It is reported that the former president of the United States spent about 950 US dollars worth of BTC to buy handmade hamburgers and diet coke for the fans at a price of 17 US dollars each.

By the way, after paying BTC, Trump turned around and made some comments to the reporters about the 50 basis point rate cut by the Fed - he said that if it wasn't for political manipulation, it would mean that the US economy is already in a very bad state.

While Trump is treating his guests, BTC is gradually strengthening under the Favourable Information of the Federal Reserve's interest rate cuts. The latest quote has already exceeded $62,000.

(BTC daily chart, Source: TradingView)

1 Embrace the encryption industry actively

Although 78-year-old Trump is unlikely to have a deep understanding of Bitcoin, he has already made multiple policy commitments to the cryptocurrency industry this year.

On Wednesday at the bar, Trump told everyone that if he wins the election in November, he will immediately stop any work related to the central bank's digital money by the Federal Reserve.

Trump also shouted to the supporters on the spot, saying that the Securities and Exchange Commission (SEC) in the United States has been very bad to them, and if he returns to the White House, he will fire SEC Chairman Gary Gensler on the first day. This commitment also sparked enthusiastic applause from the fans on the scene.

The former president also promised to turn the United States into the "global capital of Cryptocurrency and BTC", and create a "strategic BTC national reserve" for the United States, as well as a dedicated Cryptocurrency Presidential Advisory Committee. Trump also repeatedly urged onlookers not to forget to vote for him in November.

2 All about business, it's all about business!

For Trump, who once called BTC "eyewash", this year's change in stance is more related to practical considerations.

On the one hand, it's about votes and campaign funds. After promising to provide a more favorable regulatory environment at the Nashville BTC conference, the Trump camp has received millions of dollars' worth of cryptocurrency political donations.

Another layer is family interests. Trump and his two sons unveiled a new Crypto Assets business this week. In limited details, they referred to the project as "World Freedom Financial," which aims to provide opportunities to those who cannot obtain financing from traditional banks.

It is worth mentioning that Trump, a businessman by origin, is very good at using his candidacy to sell merch, and the encryption market naturally will not be overlooked. According to the campaign disclosure, Trump earned nearly $7.2 million in 2023 by licensing a Non-fungible Token company, which is selling NFT 'trading cards' featuring Trump as the theme. At the end of last year, he also issued a special edition NFT, the main content of which was the red tie and suit he wore when he was arrested in Georgia.

(Source: Trump NFT)

- Reward

- 1

- 1

- Share

Will the crypto market gather momentum for a big rise after the Federal Reserve's significant interest rate cut?

Written by 1912212.eth, Foresight News

After 4 years, the Federal Reserve finally announced a 50 basis point interest rate cut at this morning's meeting. The previously dull crypto market saw a significant pump after the interest rate decision was announced. BTC surged from a high of $59,000 to above $62,000, while ETH rose from $2,200 to break $2,400. Altcoins also benefited from the market boost, experiencing substantial gains. SEI saw a big pump of 22%, surpassing $0.34, while BLUR experienced a 17% surge, surpassing $0.2.

According to coingrass data, the total amount of Get Liquidated on the whole network in the past 24 hours was 199 million US dollars, of which 123 million US dollars were from short order Get Liquidated.

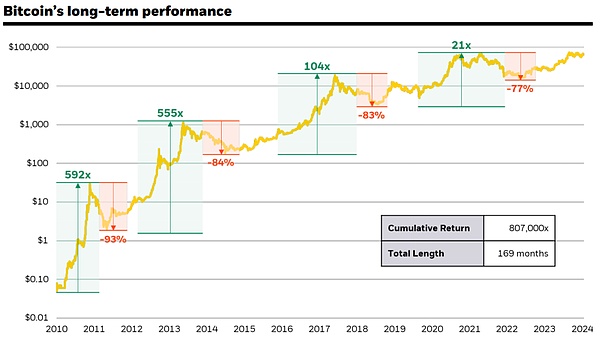

Looking back at the last cycle, after the Fed announced its first interest rate cut in years in September 2019, BTC did not respond to the Favourable Information news in the short term. Instead, the monthly chart fell 13.54%, from above $10,000, falling to around $8,300. Will the crypto market repeat history after this interest rate cut, or will it usher in a pump trend after Liquidity improves?

The Federal Reserve will continue to cut interest rates in the coming months.

This rate cut far exceeded the consensus estimate of 25 basis points, and the direct rate cut was 50 basis points. At the press conference, Powell stressed that he does not believe that a sharp interest rate cut indicates that a United States recession is approaching or that the job market is on the verge of collapse, and that the rate cut is more of a preventive action to maintain the "sound" status quo of the economy and labor market.

After the dust settles, the market generally estimates that there will be further interest rate cuts in November and December, with an expected total of 70 basis points cut within the year. The published dot plot suggests a further 50 basis point cut within the year.

The market's general concern about the possibility of a US economic recession is decreasing, and the possibility of a soft landing is increasing.

Interest rate cuts will have sustained Favourable Information on risk assets. Although it may not take immediate effect, with the passage of time and the continuity of interest rate cuts, Liquidity in the market begins to flow from bonds, banks, and other markets into stocks, Crypto Assets, and other markets.

In addition, the upcoming US presidential election in early November this year will also bring short-term volatility to the encryption market. After the official announcement of the results, OTC funds that have been hesitant to enter the encryption market may start to continuously inject.

The current Spot market volume is still in a low state, maintaining a Fluctuation of around 600 billion US dollars overall. Excluding the transient Fluctuation caused by special macro events, the market's Liquidity still performs mediocre.

Bitcoin has increasingly become a macro asset that reflects the overall economic trend. When liquidity continues to be injected into the market, encryption quotes may sweep away past gloom.

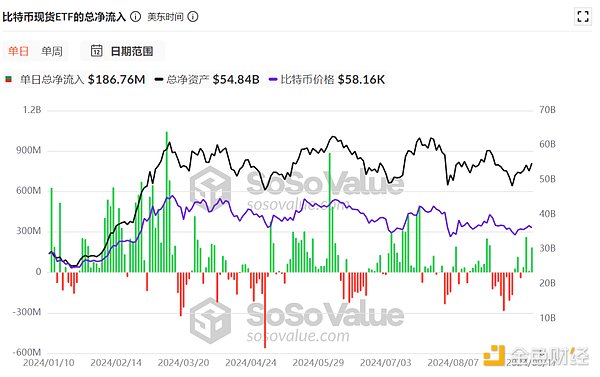

BTC Spot ETF is still net inflow

As of September 17, the BTCSpot ETF has accumulated a total net inflow of 17.5 billion US dollars. The continuous net outflow from the end of August to the beginning of September for 8 consecutive days has ended, and since September 12, the BTCSpot ETF has achieved a net inflow for 4 consecutive days.

When BTC Spot ETF continues to see net inflows, BTC prices tend to remain stable and rise. However, when there is continuous large outflow, it often leads to a downward trend in the coin price.

Currently, after experiencing a long-term price volatility in the market, OTC funds are gradually regaining confidence and continue to buy.

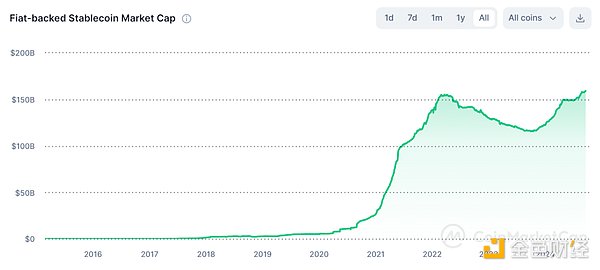

Stable CoinMarket Cap continues to rise

The total market capitalization of USDT has increased from 117 billion US dollars to 118.7 billion US dollars in the past month, with a net inflow of nearly 1.7 billion US dollars. If calculated from the total market capitalization of 104.7 billion US dollars in April this year, USDT's market capitalization has still increased by a strong inflow of 14 billion US dollars during the overall consolidation and decline of the crypto market.

The market capitalization of another major stablecoin USDC has increased from $34.4 billion at the end of August to $35.5 billion, with a flow of $1.1 billion in less than a month.

The total Market Cap of stablecoins supporting Fiat Currency has also hit a historical high and continues to climb.

October has historically been a strong performing month

The interesting thing about the encryption market is that, like some stocks, it exhibits seasonal trends. For example, the market generally performs poorly in the summer, but performs well at the end and beginning of the year. BTC has achieved strong positive returns from 2015 to 2023, except for a decline in October 2018 due to the Bear Market.

In the second half of 2023, BTC also started to rise continuously from October, coupled with the expected approval of BTC Spot ETF, thus initiating a bull run.

Market View

encryption KOL Lark Davis: 2025 will be the peak of this cycle, and it is advisable to sell in time

In his latest video released on September 9th, encryption KOL Lark Davis, who has 500,000 fans on Youtube, stated that 2025 will be the peak of this cycle and should be sold and left. He gave the following reasons for this argument: The global liquidity cycle is expected to peak in 2025 and then decline. China's credit cycle is about four years per cycle, and 2025 may be the peak of China's credit. Currently, the yield of short-term bonds is higher than that of long-term bonds, but the yield curve is gradually returning to normal, which may indicate a change in the economic cycle. Therefore, he believes that there may be a huge market chaos in 2025, followed by a Bear Market.

Glassnode: The BTC market is in a stagnation period, with both supply and demand showing signs of inactivity

Crypto market data research firm Glassnode has stated that the BTC market is currently going through a period of stagnation, with both supply and demand showing signs of inactivity. Over the past two months, BTC's actual market capitalization has reached a peak and stabilized at $622 billion. This indicates that most tokens being traded are close to their original acquisition price. Since reaching its all-time high in March, the absolute realized profit and loss has significantly decreased, meaning that overall buying pressure has eased within the current price range.

Hyblock Capital: BTC market Depth exhaustion, may indicate bullish BTC price

Shubh Verma, Co-founder and CEO of Hyblock Capital, recently stated in an interview with CoinDesk: 'By analyzing the comprehensive Spot order book, especially the order books with Depth of 0%-1% and 1%-5%, we found that low liquidity in the order book usually coincides with market bottoms. These low order book levels may be early indicators of price reversals, often preceding bullish trends'.

- Reward

- 4

- Comment

- Share

Cat20: The Final Battle of Fractal Launch Coinprotocol (Part 1)

Author: Ordslabs, @peter3050

Recently, the focus of the Fracatl ecosystem has been on the Cat20 protocol, which can cause fear of missing out for two apparent reasons:

- This is a new launch coinprotocol based on OP_CAT, which is in line with the emotional characteristics of the Web3 industry of "playing the new and not playing the old";

- Fractal's official support has further sparked the market's imagination.

After several discussions with @scryptplatform team (Cat protocol was developed by an anonymous team based on scrypt platform), we vaguely come to a conclusion that even without considering the above emotional factors, Cat20's technical features will also bring it huge development space.

1. The Dispute over Chaos Protocol

Before explaining this conclusion, let's go back to the problems faced by the BTC ecosystem launch coinprotocol: there are too many protocols, and the advantages between protocols are not obvious, which makes it impossible for anyone to convince anyone. The end result is that Liquidity and Consensus become increasingly scattered.

It can be said that there is no winner in the current BTC ecosystem launch coinprotocol battle, and the entire ecosystem is a loser. As the lowest element of the ecosystem, the standard of assets is not uniform, and it is difficult to support subsequent applications, so it is difficult to create significant wealth effects (assets in the BTC ecosystem can hardly maintain a market cap of more than 1 billion, which is extremely inconsistent with the scale of BTC). Without a significant wealth effect, it is difficult to attract funds from external users and institutions, resulting in a long-term PVP (player-versus-player) situation in the ecosystem.

2. Cat20: Fractal's "Chosen One"

Fractal maintained a lot of consistency with BTC in its design, but there are also some obvious differences, such as faster block speed (increased by 20 times) and larger block size. These changes will also have a significant impact on the launch coin protocol. For example, in the scenario of BRC20, with a layer of 10 minutes per block time, a large number of users have enough time to participate, forming a larger Consensus.

But on Fractal, the fast block generation time makes the whole process almost instant. Apart from script experts who can quickly acquire chips, many retail investors simply don't have enough time to get on board. As @0xquqi said, even a group of 500 people pumping is not enough in the end. To increase Consensus, a simple method is to greatly expand the quantity of assets, giving more people time to get on board. However, this will lead to asset inflation, a decrease in scarcity, and a deviation from value.

How to issue assets on Fractal in a way that avoids quantity flooding, ensures enough time for more people to participate, and thus generates stronger Consensus? Cat20 seems to solve this problem.

As shown in the example, Cat20 is based on OP_CAT, with programming capabilities, which can set some pre-rules in the mint process, so that the minting process can last for a certain period of time or cover a wider range of people. In addition, the scrypt team has confirmed that these rules can form customized templates, and there may be tools in the future to facilitate the project party in setting the required rules for issuing coins.

The ideal launch coin process may be similar to the process of BTC Mining: difficult, low threshold.

- Difficulty: set rules during the minting process (such as the password puzzle for BTC), so that everyone needs a certain amount of time to mint, and the probability of success for everyone tends to be the same.

- Low threshold: Ordinary users can also participate in minting, just like participating in BTC mining through a Mining Pool. In the future, with the improvement of the Cat20 infrastructure, it is entirely possible to create a "challenging and low-threshold" launch coin process on Fractal, allowing more users to participate fairly and produce a stronger consensus in the first step.

Therefore, the programmability and other features of Cat20 are expected to become the most suitable launch coinprotocol in the Fractal environment.

The first half of this article mainly explains that Cat20 is likely to become the most successful launch coinprotocol on Fractal. In the second half, we will discuss whether Cat20 has the potential to unify various protocols in the BTC ecosystem, end the dispute over protocols, and lead the industry into the next stage, stay tuned.

- Reward

- 4

- Comment

- Share

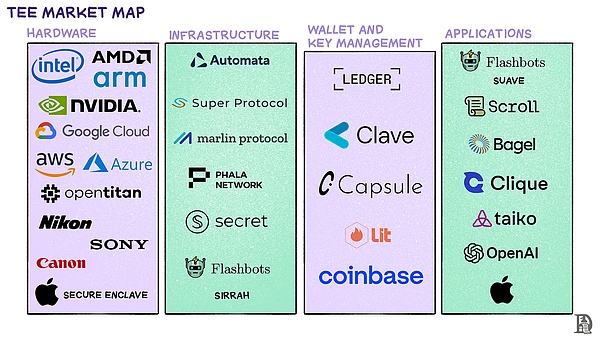

Various blockchain technologies TEE why so important

Compiled by Yangz, Techub News

Uber's San Francisco headquarters, like most tech companies, has an open floor plan where employees can freely move around and share their ideas. However, at the center of the main floor, there is a room that few employees venture into. The metal and glass exterior walls, a switch that can make transparent glass opaque, and frequent security personnel make this room appear very mysterious.

This is Uber's "War Room," an all-day operating space primarily for executives to brainstorm solutions to the company's biggest challenges. To maintain secrecy, the room strictly adheres to the "need to

Authored by: Oliver Jaros, CMT Digital analyst, Shlok Khemani, decentralised.co

Compiled by Yangz, Techub News

Uber's San Francisco headquarters, like most tech companies, has an open floor plan where employees can freely move around and share their ideas. However, at the center of the main floor, there is a room that few employees venture into. The metal and glass exterior walls, a switch that can make transparent glass opaque, and frequent security personnel make this room appear very mysterious.

This is Uber's "War Room", an around-the-clock space mainly for executives to brainstorm and solve the company's biggest problems. In order to maintain confidentiality, this room is strictly open according to the "need to know" principle. Such security measures are extremely necessary, as Uber needs to engage in fierce competition with competitors around the world to dominate the ride-hailing market, and its opponents will not miss any opportunity to leak its strategy. Everything that happens in the war room will stay in this room.

*Uber's war room interior; Source: Andrew Chen, a16z

This practice of setting up private compartments within the original space is very common. When Apple is conducting secret projects, it will place designated teams in other buildings separate from the headquarters. The Capitol and other US government buildings have Sensitive Compartmented Information Facilities (SCIF) that provide soundproofing and electromagnetic shielding for sensitive discussions. Our own homes or hotel rooms we stay in also have safes.

Secure Enclaves have extended beyond the physical world. Today, we primarily store data and process information through computers. As our reliance on silicon-based machinery continues to rise, the risk of attacks and leaks is also increasing. Similar to Uber's war room, computers need a separate space to store the most sensitive data and perform critical computations. This space is called a Trusted Execution Environment (TEE).

Although TEE has become a popular term in the cryptocurrency industry, its purpose and functionality are often misunderstood. We hope to change this situation through this article. Here, we will explain everything you need to know about TEE, including what they are, why they are important, how we use them every day, and how they help build better Web3 applications.

TEE is everywhere.

First, let's understand the definition of TEE.

TEE is a dedicated secure area within the device's main processor, which ensures the confidentiality of the data and code being processed. TEE provides an isolated execution environment independent of the main operating system, which is crucial for maintaining the data security of applications handling sensitive information.

TEE provides two main guarantees.

- Isolation execution: TEE runs code in an isolated environment. This means that even if the main operating system is compromised, the code and data in TEE are still secure.

- Memory encryption: All data processed in TEE is encrypted. This ensures that even if an attacker accesses physical memory, they cannot decipher the sensitive information stored in TEE.

To understand the importance of TEE, the device in your hands that you may be using to read this article, the iPhone, is a great example. FaceID has become the primary way for iPhone users to authenticate access to their devices. In a matter of milliseconds, the device goes through the following process:

- First, the dot matrix projector will project over 30,000 invisible infrared (IR) dots onto the user's face. An infrared camera captures this pattern and the infrared image of the face. Under low light conditions, the flood illuminator improves visibility.

- Secondly, the processor receives these raw data and creates a mathematical model of the face, including Depth data, contours, and unique features.

- Finally, the mathematical model is compared with the model stored during FaceID initial setup. If the model is accurate enough, a 'success' signal will be sent to the iOS system, and the device will be unlocked. If the comparison fails, the device will remain locked.

When unlocking the phone, 30,000 infrared dots projected onto the face; Source: YouTube

FaceID is not only used to unlock the device, but also to verify other operations, such as logging in to applications and making payments. Therefore, any security vulnerability will have serious consequences. If the model creation and comparison process is compromised, non-device owners can unlock the device, access the owner's personal data, and conduct fraudulent financial transactions. If attackers manage to extract stored user facial mathematical models, it will result in biometric data theft and serious privacy infringement.

Of course, Apple is very particular about the implementation of FaceID. All processing and storage are done through The Secure Enclave, which is a dedicated processor built into the iPhone and other Apple devices, with functions isolated from other memory and processes. Its design purpose is to prevent access even if other parts of the device are attacked. In addition to biometric technology, it can also store and protect user payment information, passwords, keychains, and health data.

Apple's The Secure Enclave is just an example of TEE. Since most computers need to process sensitive data and calculations, almost all processor manufacturers now provide some form of TEE. Intel provides Software Guard Extensions (SGX), AMD has AMD Secure Processor, ARM has TrustZone, Qualcomm provides Secure Foundation, and Nvidia's latest GPU comes with secure computing capabilities.

There are software variants of TEE as well. For example, AWS Nitro Enclaves allows users to create isolated computing environments to protect and process highly sensitive data in Amazon's regular EC2 instances. Similarly, Google Cloud and Microsoft Azure also offer confidential computing.

Apple recently announced the launch of Private Cloud Compute, a cloud intelligent system designed to privately handle artificial intelligence requests that devices cannot serve locally. Similarly, OpenAI is also developing secure infrastructure for artificial intelligence cloud computing.

One of the reasons TEEs are exciting is that they are ubiquitous in personal computers and cloud service providers. It enables developers to create applications that benefit from user sensitive data without worrying about data leaks and security vulnerabilities. It can also directly improve user experience through innovative technologies such as biometric authentication and passwords.

So, what does this have to do with Crypto Assets?

Remote Attestation

TEE provides the possibility of tamper-resistant computing for external parties, and blockchain technology can also provide similar computing guarantees. Smart contracts are essentially computer code that, once deployed, will execute automatically and cannot be altered by external participants.

However, there are some limitations to running computations on the Blockon-chain: 01928374656574839201

- Compared to ordinary computers, the processing power of the Block chain is limited. For example, a Block on the ETH network generates every 12 seconds and can only accommodate up to 2 MB of data. This is smaller than the capacity of a floppy disk, which is already an outdated technology. Although the speed and functionality of the Block chain are increasing, they still cannot perform complex algorithms, such as the algorithm behind FaceID.

- The blockchain lacks native privacy. All ledger data is visible to everyone, so it is not suitable for applications that rely on personal identities, bank balances, credit scores, medical histories, and other private information.

TEE has no such restrictions. Although TEEs are slower than ordinary processors, they are still several orders of magnitude faster than the Block chain. In addition, TEEs themselves have privacy protection functions, and by default, they will encrypt all processed data.

Of course, on-chain applications that require privacy and stronger computing power can benefit from the complementary functions of TEE. However, blockchain is a highly trusted computing environment, and every data point on the ledger should be traced to its source and replicated on numerous independent computers. In contrast, TEE processes occur in local physical or cloud environments.

So, we need a way to combine these two technologies, which requires the use of remote attestation. So, what is remote attestation? Let's take a detour to the Middle Ages and first understand the background.

Before the invention of technologies such as telephone, telegraph, and the internet, the only way to send long-distance messages was through handwritten letters delivered by human messengers. However, how could the recipient ensure that the information truly came from the intended sender and had not been tampered with? For centuries, wax seals have been the solution to this problem.

Envelopes containing letters are sealed with intricate and complex designs using hot wax, typically featuring the coat of arms or insignia of kings, nobles, or religious figures. Because each design is unique to the sender and cannot be easily replicated without the original seal, the recipient can be assured of the authenticity of the letter. Additionally, as long as the seal remains intact, the recipient can also be confident that the information has not been tampered with.

The Great Seal of the Realm: used to symbolize the monarch's approval of state documents

Remote attestation is equivalent to a modern seal, that is, an encryption proof generated by TEE, allowing the holder to verify the integrity and authenticity of the code running inside, and confirm that the TEE has not been tampered with. Its working principle is as follows:

- TEE generates a report containing information about its status and internal operating code.

- The report uses Secret Key for encryption signature, which can only be used by genuine TEE hardware.

- The signed report will be sent to the remote verifier.

- The validator will check the signature to ensure that the report comes from a genuine TEE hardware. Then it will verify the report content to confirm that the expected code is running and has not been modified.

- If the verification is successful, the remote party can trust the TEE and the code running inside it.

In order to combine blockchain with TEE, these reports can be published on-chain, and validated by designated smart contractsproof of validation.

So, how does TEE help us build better Cryptocurrency applications?

Practical Applications of TEE in the Block Chain

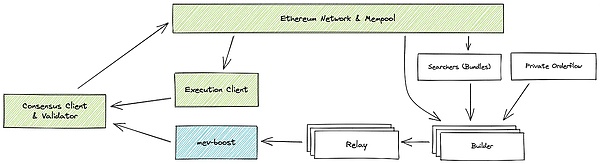

As the "leader" in the MEV infrastructure of the ETH network, Flashbot's MEV-boost solution separates Block proposers from Block builders and introduces a trusted entity called "intermediary" between them. The intermediary verifies the validity of the Block, conducts auctions to select the winning Block, and prevents validators from taking advantage of MEV opportunities discovered by the builder.

MEV-Boost Architecture

However, if the relayer is centralized, such as three relayers processing more than 80% of the Block, there will still be problems. As outlined in this blog post, this centralization carries the risk of relayer reviewing transactions, colluding with builders to prioritize certain transactions over others, and the risk of relayers themselves potentially stealing MEV.

So why don't Smart Contracts implement Relay functionality directly? First of all, the Relay software is very complex and cannot run directly on-chain. In addition, using a Relay is to maintain the privacy of the inputs (Blocks created by the builder) to prevent MEV theft.

TEE can solve this problem very well. By running Relay software in TEE, the relay can not only maintain the privacy of the input Block, but also prove that the winning Block is fairly selected without collusion. Currently, Flashbots is developing SUAVE (in testing) is a TEE-driven infrastructure.

Recently, we discussed with CMT Digital about how Solver network and Intent can help abstract the chain and solve the user experience problems of Cryptocurrency applications, and we both mentioned such a solution, that is, order flow auction, which is a general version of auction in MEV boost, and TEE can improve the fairness and efficiency of these order flow auctions.

In addition, TEE is also very helpful for the DePIN application. DePIN is a device network that rewards tokens in exchange for contributing resources such as bandwidth, computing power, energy, mobile data, or GPU. Therefore, the supplier has a strong motivation to deceive the system by changing the DePIN software, for example, by displaying duplicate contributions from the same device to earn more rewards.

However, as we can see, most modern devices have some form of built-in TEE. The DePIN project can require proof of a device's unique identifier generated through TEE, ensuring that the device is genuine and running the expected security software, thereby remotely verifying the legitimacy and security of contributions. Bagel is an ongoing exploration of using TEE in the data DePIN project.

In addition, TEE also played an important role in the Passkey technology discussed by Joel recently. Passkey is an authentication mechanism that stores the Private Key in local devices or cloud solutions TEE, users do not need to manage mnemonic words, and supports cross-platform Wallet, allowing social and biometric authentication, and simplifying the recovery process of Secret Key.

Clave and Capsule apply this technology to embedded consumer Wallet, while hardware Wallet company Ledger uses TEE to generate and store Private Key. Lit Protocol, invested by CMT Digital, provides the infrastructure for developers of applications, Wallet, protocol, and artificial intelligence agents to sign, encrypt, and compute Decentralization. The protocol uses TEE as part of its Secret Key management and network computation.

There are also other variations of TEE. With the development of generative AI, it has become increasingly difficult to distinguish between AI-generated images and real images. To address this, major camera manufacturers such as Sony, Nikon, and Canon are integrating technology for real-time allocation of Digital Signatures to captured images. They also provide infrastructure for third parties to verify the origin of the images through proof of validation. While this infrastructure is currently centralized, we hope that these proofs will be validated on-chain in the future.

Last week, I wrote an article about how zkTLS can bring Web2 information into Web3 in a verifiable way. We discussed two methods of using zkTLS, including multi-party computation (MPC) and proxy. TEE provides a third method, which is to handle server connections in a secure enclave of the device and publish computational proofs on-chain. Clique is a project that is implementing zkTLS based on TEE.

In addition, the ETH platform L2 solution Scroll and Taiko are trying multiple proof methods, aiming to integrate TEE with ZK proof. TEE can generate proofs faster and more cost-effectively without increasing the final time. They complement ZK proofs by increasing the diversity of proof mechanisms and reducing errors and vulnerabilities.

At the infrastructure level, there have also been projects that support the use of TEE remote attestation for more and more applications. Automata is launching a modular verification chain, serving as the Eigenlayer AVS, acting as a registration center for remote verification, making it publicly verifiable and easily accessible. Automata is compatible with various EVM chains and enables composability of TEE attestation throughout the EVM ecosystem.

In addition, Flashbots is developing a TEE coprocessor Sirrah to establish a secure channel between TEE Nodes and the blockchain. Flashbots also provide developers with code to create Solidity applications that can easily verify TEE proofs. They are using the Automata verification chain mentioned above.

"Roses have thorns"

Although TEE is widely used and has been applied in various fields of Crypto Assets, adopting this technology is not without challenges. It is hoped that the builders who adopt TEE can bear in mind some key points.

First and foremost, the most important consideration is that TEE requires a trusted setup. This means that developers and users must trust that the device manufacturer or cloud provider will adhere to security guarantees and not have (or provide to external actors such as governments) backdoors into the system.

Another potential issue is side-channel attacks (SCA). Imagine a multiple-choice test taking place in a classroom. Even though you can't see anyone's answer sheet, you can certainly observe the varying lengths of time spent by nearby classmates when selecting different answers.

The principle of side channel attacks is similar. Attackers use indirect information such as power consumption or timing variations to infer sensitive data processed inside the TEE. To reduce these vulnerabilities, it is necessary to carefully implement encryption operations and constant time Algorithm to minimize observable variations during TEE code execution as much as possible.

Intel SGX and other TEEs have been proven to have vulnerabilities. The 2020 SGAxe attack exploited a vulnerability in Intel SGX to extract the encryptionSecret Key from the secure enclave, potentially exposing sensitive data in cloud environments. In 2021, researchers demonstrated the 'SmashEx' attack, which could lead to enclave crashes and potential leakage of confidential information. 'Prime+Probe' is also a form of side-channel attack that can extract the encryptionSecret Key from SGX peripheral devices by observing cache access patterns. All these examples highlight the 'cat-and-mouse game' between security researchers and potential attackers.

Most servers in the world use Linux for its powerful security. This is thanks to its open source nature, and the thousands of programmers constantly testing the software and fixing vulnerabilities. The same approach also applies to hardware. OpenTitan is an Open Source project aimed at making silicon Root of Trust (RoT, another term for TEE) more transparent, trustworthy, and secure.

Future Outlook

In addition to TEE, there are several other privacy protection technologies available for builders to use, such as Zero-Knowledge Proof, longer computation, and fully Homomorphic Encryption. A comprehensive comparison of these technologies is beyond the scope of this article, but TEE has two prominent advantages.

First, there is its ubiquity. The infrastructure of other technologies is still in its infancy, while TEE has become mainstream and has been integrated into most modern computers, dropping the technological risk for founders who want to use privacy technology. Secondly, compared to other technologies, the processing overhead of TEE is much lower. Although this feature involves security trade-offs, it is a practical solution for many use cases.

Finally, if you are considering whether TEE is suitable for your product, please ask yourself the following questions:

- Does the product require complex off-chain computation to be proven on-chain?

- Do application inputs or main data points need to be anonymized?

If all the answers are yes, then TEE is worth a try.

However, given the fact that TEEs are still vulnerable, always be vigilant. If the security value of your application is less than the cost of an attack, which can cost millions of dollars, you may want to consider using TEE alone. However, if you're building a security-first application, such as Wallet and Rollup, you should consider using a Decentralization TEE network such as the Lit Protocol, or using TEE in conjunction with other technologies such as ZK proofs.

Unlike developers, investors may be more concerned about the value of TEE and whether there will be billion-dollar companies emerging due to this technology.

In the short term, as many teams continue to experiment with TEE, we believe that value will be generated at the infrastructure level, including TEE-specific Rollups (such as Automata and Sirrah), as well as protocols that provide critical components for other applications using TEE (such as LIT). With the introduction of more TEE coprocessors, the cost of off-chain privacy computation will drop.

In the long run, we expect the value of applications and products utilizing TEE to exceed that of the infrastructure layer. However, it should be noted that users adopt these applications not because they use TEE, but because they are excellent products that solve real problems. We have seen this trend in wallets such as Capsule, where the user experience has been greatly improved compared to browser wallets. Many DePIN projects may only use TEE for identity verification, rather than as a core part of their product, but they will also accumulate significant value.

Every week, our confidence in the assertion that 'we are in a transition from fat protocols to fat applications' grows stronger. We hope that technologies such as TEE will also follow this trend. The timeline on X won't tell you this, but with the maturity of technologies like TEE, the cryptocurrency field will usher in an unprecedentedly exciting moment.

- Reward

- like

- Comment

- Share

Must-read 5 articles in the evening | Will interest rate cuts restart the Bull Market for Cryptocurrency?

2. Kyle Samani pointed out in his speech that Ethereum has development bottlenecks, and Solana will surpass Ethereum;

3. Variant partners believe that the credit card network can reveal Stable Coin entrepreneurial opportunities;

4. The Fed cuts interest rates for the first time, and global institutional chiefs make judgments;

5. Will the Fed rate cut restart the Cryptocurrency Bull Market, causing excitement among stock and Cryptocurrency investors.

1. The Federal Reserve cuts interest rates by 50 basis points, BTC breaks through $62,500: a new cycle is starting

On September 19th, Beijing time, the Federal Reserve officially announced a 50 basis point cut in the federal funds Interest Rate to 4.75%-5.00%, marking the first rate cut since March 2020. In response to the news of the rate cut, the crypto market surged, with BTC breaking through $62500, outperforming the US stock market and Spot gold in terms of gains. What is even more anticipated is that longer institutional experts have indicated that the 50 basis point rate cut in September is just the beginning, and there may still be further rate cuts within the year, accumulating to 76 basis points by the end of 2024. Click to read more

2. Kyle Samani Token2049 Speech: Why Solana Will Surpass Ethereum

With the rapid development of blockchain technology, Ethereum, as a leader in the industry, has achieved great success. However, after 9 years of development, it took 5 years to determine the expansion plan and another 7 years to complete the transition from Proof of Work (PoW) to Proof of Stake (PoS). Ethereum has never been clear about what it wants to be. The expansion plan keeps changing without a clear direction. Click to read more.

3.Variant Partner: What Stablecoin Entrepreneurial Opportunities Can Credit Card Networks Reveal

Stablecoin is the most revolutionary form of payment since credit cards, changing the way funds flow. Due to low cross-border fees, near-instant settlement, and global accessibility, stablecoin has the ability to transform the financial system. For those who hold US dollar deposits supported by digital assets, stablecoin can also be a very profitable business. Click to read.

4. Fed cuts rates by 50 basis points for the first time in over four years, six top institutions' chief assessment globally

At 2 a.m. Beijing time on September 19, the Federal Open Market Committee (FOMC) of the Federal Reserve announced a 50 basis point reduction in the federal funds Intrerest Rate to 4.75%~5.00%, exceeding market expectations, marking the first rate cut since March 16, 2020. Click to read

5. Will rate cuts restart the Bull Market of Cryptocurrency?

The Federal Reserve just announced a rate cut, the first since the outbreak of the epidemic, as expected, slashing 50 basis points. This long-awaited decision immediately sparked excitement among stock and Crypto Assets investors. Click to read

- Reward

- like

- Comment

- Share

In-depth Analysis of the Value of WLF: A New Choice Under Trump's Campaign Financial Disadvantage

Summary: Discovered an interesting topic during the holiday, and researched the World Liberty Financial, which has been very hot these days. The Decentralized Finance project involving Depth, a member of the Trump family, made more detailed commitments in the twitter space on September 17, including the allocation of WLFI Token, the vision of the project, and so on. Trump also spent a long time at the meeting talking about an optimistic attitude towards the encryption field. So, for such a project that doesn't seem so 'Web3 style', how to grasp its value, I have done some research on this point, and I would like to share some insights with you. Overall, I think World Liberty Financial

Author: Web3Mario Source: X, @web3_mario

Summary: Discovered an interesting topic during the holiday, and researched World Liberty Financial, a Decentralized Finance project with involvement from members of the Trump family in the high-heat of the past two days. In the twitter space on September 17th, more detailed commitments were made, including the allocation of WLFI Tokens, the vision of the project, etc. Trump also spent a long time in the meeting expressing optimism about the field of encryption. So for a project that seems not so 'Web3 style', how should we grasp its value? On this point, the author did some research, gained some insights, and is sharing with everyone. Overall, I believe the core value of World Liberty Financial lies in finding new fundraising channels to alleviate the disadvantage of Trump's 2024 campaign in fundraising. Therefore, the essence of investing in WLFI Tokens is a bet on Trump's election, which is a form of political contribution.

The negative image of the joint creation and the lack of specific roadmaps make World Liberty Financial quite controversial.

The background of this project has been introduced in many articles. Here is a brief review. In fact, the project has been quite controversial since its announcement, with controversy focusing on three aspects:

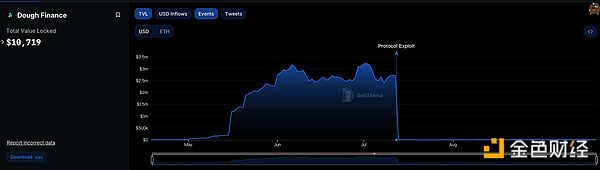

Negative background of the co-founders: Considering the involvement of Eric Trump and Donald Trump Jr., who have limited experience in the encryption industry and are more associated with real estate, it is widely believed that the actual operators of the project are their co-founders, Zachary Folkman and Chase Herro. Trump mentioned in the live broadcast that Herro and Folkman were introduced to his sons by real estate investor Steve Witkoff. Prior to this, the two had collaborated on a Decentralized Finance lending project called Dough Finance, which was established in April 2024 and suffered a Flash Loans attack on July 12, leading to a loss of more than 1.8 million USD, after which the project entered a stagnant state. In addition, their resumes do not align with the typical elite path of most technology or financial industry entrepreneurs. Folkman's previous influential project was called 'Data Hotter Girls', a dating coaching seminar, while Herro has a criminal record.

The product roadmap is not clear: Although the Trump family has been promoting the project vigorously with vague descriptions and promises of doing many things at the same time over the past month, in fact, the project is not likely to publicly release some more detailed and accurate plans or descriptions. In this Twitter space, Folkman seems to give some descriptions, the project is not trying to create brand new financial tools, but aims to improve the usability of Decentralized Finance. During the fireside chat, Donald Trump Jr. talked about his family's experience of "debanking," which refers to the difficulties that some individuals or companies encounter when obtaining credit from traditional Financial Institutions. So it's not hard to see that the initial focus of the project's launch will still be on the lending scene, but such information seems insufficient to convince most people and acknowledge its vision and business logic.

Centralization Issue of WLFI Token Economics: In this interview, Folkman also provided a detailed distribution plan for WLFI Token. 20% of the project's tokens are allocated to the founding team, including the Trump family, 17% of the tokens are used for user rewards, and the remaining 63% of the tokens will be available for public purchase. However, such allocation proportions seem to be quite different from traditional Web3 projects. Tokens are basically concentrated in the hands of the team and Whales, and there is no allocation for community incentives.

So why would such a seemingly unattractive project receive strong support from the Trump family, especially at this sensitive time near the election? I think the core reason is to find new fundraising channels and alleviate the disadvantage of fundraising for Trump's 2024 campaign. Therefore, the essence of investing in WLFI Token is a bet on Trump's election, a form of political contribution.

Trump's current campaign funding has a clear disadvantage and hopes to find more flexible fundraising channels

We know that the federal government of the United States is composed of three parts, the legislative, judicial, and executive branches, with the executive branch obtaining positions through appointment, recruitment, or examination. The legislative branch, specifically Congress, is composed of the Senate and the House of Representatives, with members of both houses being elected, while the judicial branch is in between the two. Different states have different regulations, and during his presidency, Trump appointed more than 200 federal judges, greatly altering the ideological composition of the federal judicial system. This is also the reason why he was able to maintain countermeasures during the legal litigation crisis in the first half of the year.

The essence of the election is a political show, which requires a large amount of funding for publicity in order to gain more support from voters, and the channels of publicity cover all aspects online and offline. Considering that the entire publicity actually started nearly a year before the election, the long cycle requires far more capital consumption than events such as movie releases or concerts. The pace of publicity is affected by some unexpected events, but it is highly likely to maintain an increasing trend to allocate budgets, and the closer to the general election, the faster the expenditure.

Due to having legislative power, interest groups will form between the government and business during this process. Some large-scale entrepreneurs will choose to support some politicians in exchange for the promotion of certain bills that align with their own interests after the politician's successful election. This donation is called political contribution. In order to prevent excessive rent-seeking and the worst form of corruption, U.S. laws have designed some acts to standardize the entire process. Among them, '527 organization' is a tax-exempt organization designed for candidates to raise funds to support elections, with many specific sub-types based on the scale of capital received and the different ways of use.

In general, the performance of politicians in some key events or their encounters with sudden events will significantly affect the amount of funds they raise, because the support of sponsors to politicians is also phased. For example, a bad debate or a sudden scandal will affect the sponsor's confidence in the entire future election, thus stopping donations. Therefore, the fundraising situation can accurately reflect the performance of the candidates.

After introducing this background knowledge, let's take a look at the difference in fundraising between the Trump 2024 campaign team and the current Harris 2024 campaign team. This difference mainly manifests in two aspects, the scale of funds and the efficiency of allocation.

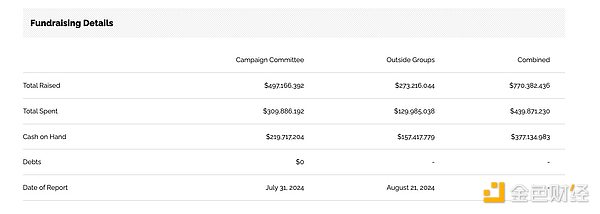

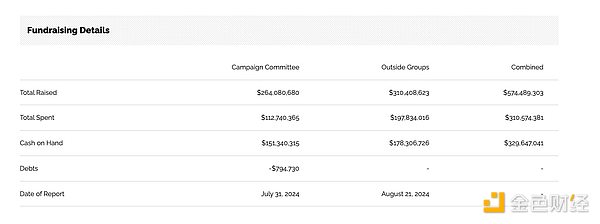

First of all, in terms of fundraising, the fact is that the Democratic Party has always been ahead of the Republican Party in terms of fundraising scale. This situation has become more and more intense after Harris was confirmed, and it seems that the supporting forces within the Democratic Party have been integrated, and they have started to support this candidate with relatively little experience. Up to now, the Harris team has raised a total of 770 million US dollars and has spent 440 million US dollars. The Trump team has raised a total of 570 million US dollars and has spent 310 million US dollars. Whether it is from the perspective of remaining funds or past investments, the Trump team undoubtedly has a significant disadvantage. This is also why, after being assassinated, in addition to successfully forcing the Democratic Party to replace Biden, Trump's momentum has been declining. Moreover, in the first presidential debate last week, in terms of debate skills, Harris undoubtedly performed better, which enabled her to raise 50 million US dollars within 24 hours after the debate, demonstrating her strong fundraising ability.

Of course, it's also interesting to see the differences in supporters between the two. After Biden attracted support from billionaires like Michael Bloomberg and LinkedIn founder Reid Hoffman, Harris herself has also gained support from several wealthy individuals, including Hoffman, Netflix co-founder Reed Hastings, former Meta COO Sheryl Sandberg, and philanthropist Melinda French Gates (Bill Gates' wife). On July 31, over 100 venture capitalists signed a letter supporting Harris' candidacy and pledging to vote for her, including entrepreneurs Mark Cuban, investors Vinod Khosla and Lowercase Capital founder Chris Sacca, and other billionaires. Trump's core supporters include banker Timothy Mellon, wrestling tycoon Vince McMahon's wife Linda McMahon, energy executive Kelcy Warren, BCH Supply founder Diane Hendricks, oil tycoon Timothy Dunn, and prominent conservative donors Richard and Elizabeth Uihlein, as well as TSL founder Elon Musk. However, it can be seen from this list that Harris' supporters are mostly from emerging technology industries, while Trump's supporters focus on traditional industries. In terms of online promotion, Harris undoubtedly has a stronger advantage, thanks to Musk's acquisition of Twitter. This helps Trump alleviate this disadvantage, so you will find that after Trump returns to Twitter, his online marketing will undoubtedly revolve around this platform.

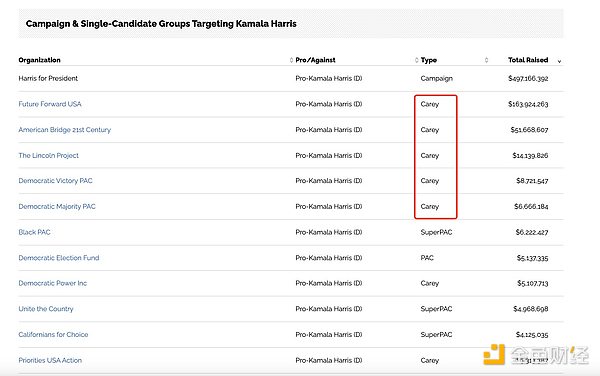

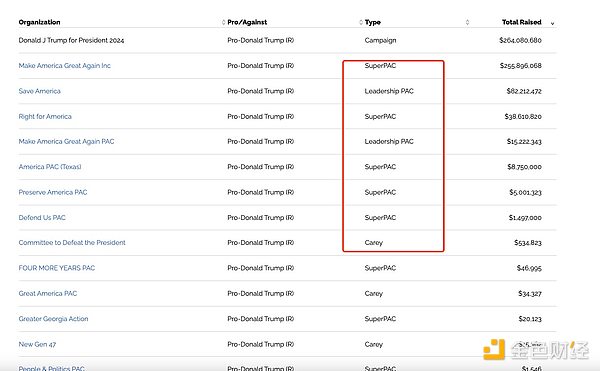

And in terms of specific funding sources, Harris's external funding channels are mainly through the Carey Committee, while Trump relies mainly on SuperPAC. Both organizations belong to the 527 organization just introduced, with the advantage of unlimited funding. However, in terms of fund expenditure, the former has greater flexibility. The Carey Committee has two separate accounts: one for traditional restricted donations (which can be donated directly to candidates and parties), and the other for unrestricted independent expenditures (used for advertising, publicity, etc.). However, Super PACs cannot directly coordinate with a candidate's campaign team or party, nor can they donate directly to a candidate. This makes Trump's team much weaker in terms of funding efficiency compared to Harris's team.

This will break everyone's traditional impression that Trump, as a wealthy businessman, should have more advantages in terms of funds. However, the situation is exactly the opposite. The Harris team currently has a clear funding advantage, and this advantage is further expanding. So, at this time, it is easy to understand why such an immature encryption project is launched at the risk, which also shows the hope of finding more flexible fundraising channels through the encryption field. This can also be seen as a practical expression of pleasing encryption enthusiasts and voters in the past. So it is worth taking some risks for this, and of course, this also explains why the project is based on the explanation that WLFI will follow Regulation D for fundraising without a detailed roadmap, which is a guarantee to control risks within an acceptable range. This is the key to the problem.

So for the Trump team, there are actually many ways to benefit from this project, besides direct ICO sales. There is also an interesting project, which is to cash out using the lending platform. Do you still remember the issue that Donald Trump mentioned about his family facing de-banking? Assuming that World Liberty Financial successfully launches as a lending protocol and attracts certain funds, the team will be able to use a large amount of WLFI tokens controlled as collateral to lend real money on the platform without causing significant impact on the secondary market price, just like the founder of Curve. This can indeed alleviate the problems they encounter.

So considering these, I have no doubt about the start of the project, because the essence of investing in WLFI Token is a bet on Trump's election, which is a kind of political donation. This scheme will be favored by many billionaires in the encryption field. The future growth depends on the result of this game. If Trump is successfully elected, such a resource-driven project will easily find a specific business direction. And if it fails, undoubtedly, in an environment exhausted by various litigations, the Trump family should also have no time to deal with this. In all, as small investors, we still need to be cautious and participate carefully.

- Reward

- like

- Comment

- Share

Will a rate cut restart the Bull Market for Cryptocurrency?

Author: Jack Inabinet Source: bankless Translation: Shan Ou Ba, Golden Finance

The Federal Reserve just announced a rate cut, the first since the epidemic, as expected, a significant 50 basis point reduction. This long-awaited decision immediately sparked excitement among stock and Crypto Assets investors.

Powell's printing press has finally restarted, which is why many people in the market are optimistic that this rate cut could trigger another Cryptocurrency Bull Market.

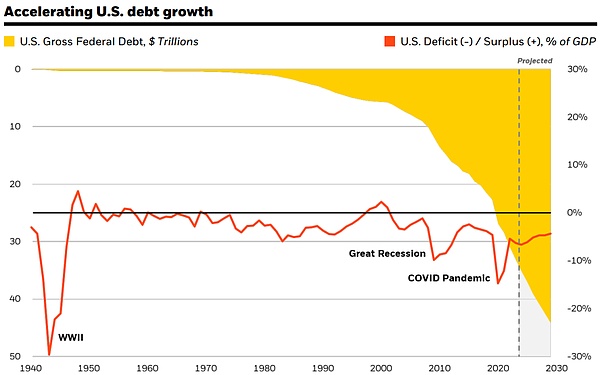

In 2022, the Federal Reserve raises interest rates to combat high inflation, resulting in rising borrowing costs and falling asset prices, triggering a Bear Market. However, with the decline in interest rates, many people expect that loose monetary policies may gently guide the global economy to achieve a soft landing.

If inflation no longer soars, and rate cuts help maintain stable unemployment, Central Bank governors can achieve incredible feats - eliminating major economic uncertainty and achieving global economic stability levels unseen in decades!

Despite the latest economic forecast from the Federal Reserve seeming to lean towards further rate cuts in the future, it also reflects the uncertainty of the situation, with inflation forecasts being lowered, GDP estimates remaining flat, and a significant rise in the unemployment rate expected.

The biggest economic risk has shifted from inflation rise to declining employment rate, and the decision to cut interest rates is a clear evidence. Although Federal Reserve officials and other central bank governors are confident in managing these risks through further rate cuts, any sustained economic downturn could quickly turn into serious recession concerns.

Global bond yields, which have been rising since Tuesday, only fell slightly after the interest rate cut was confirmed, indicating that the market has already factored in this factor and started to rise early from July. Although BTC rose by about 2% after the interest rate cut news came out, the market quickly started dumping and wiped out the gains before the close.

While the initial excitement brought by the interest rate cut is evident, the rapid market reversal indicates that uncertainty still exists. Investors are now closely following the economy's response to these changes, hoping for a smooth transition but remaining cautious about potential turbulence in the future. As the balance between inflation, employment, and rise continues to unfold, it remains to be seen whether this will truly trigger the next Cryptocurrency Bull Market or provoke deeper concerns about a recession.

- Reward

- like

- Comment

- Share

Is Babylon's market expectations overestimated?

It has been nearly a month since the launch of @babylonlabs_io Mainnet, but the market response for BTCFi is not as enthusiastic as expected. So, what problems were exposed during the first phase of stake in Babylon? Does Babylon's sustainable interest narrative logic hold true? Was the market expectation for Babylon overestimated? Next, let me share my thoughts:

1) The innovative core of Babylon adopts a Self-Costodian self-hosting approach, allowing users' BTC assets to be locked in BTCMainnet in the form of script contracts, while also being able to in many BTC

Author: haotian

It has been nearly a month since the launch of @babylonlabs_io Mainnet, but the market response for BTCFi is not as enthusiastic as expected. So, what problems were exposed during the first phase of stake in Babylon? Does Babylon's sustainable interest narrative logic hold true? Was the market expectation for Babylon overestimated? Next, let me share my thoughts:

- The innovative core of Babylon adopts the Self-Custodian self-custody method, which locks users' BTC assets in the form of script contracts on the BTC Mainnet, and can output 'secure consensus services' on many BTC layer2s to obtain rich benefits provided by other extension chains.

At this stage, only the first half of this sentence is true. Indeed, Babylon's sophisticated and complex cryptographic Algorithm architecture allows users to potentially earn additional income while holding BTC in a self-custody form. Other CeDeFi or Wrapped forms require a third-party custodial platform for native BTC to break free from the original chain's constraints, but Babylon does not. If the Wallet supports it, users can see that the BTC they stake to Babylon protocol still appears in their balance.

And the latter half of this sentence can only be considered as an immature "pie" at present. Because to transform Babylon's secure Consensus into services and generate income, the following prerequisites are needed:

Firstly, there must be a large number of users, including Validators Nodes with a significant proportion of voting power, staking BTC in Babylon deployed within the BTC Mainnet protocol.

Secondly: it is necessary to aggregate a large amount of LST assets and generate strong Liquidity to form the foundation for the growth of the ecological users and TVL.

Thirdly: there should be a large number of newly born layer2 POS chains to 'procure' Babylon's secure Consensus services and provide sustainable Yield income.

- Currently, Babylonprotocol has only opened a limited stake of 1,000 BTC for the first phase, which can only be considered as an experimental launch phase, but it has exposed many problems, making it challenging to meet the above three prerequisites. For example:

- The stake process interacting with the Babylon protocol will result in a higher 'transaction fee loss'.

Including: the overall transaction fee surge caused by the network FOMO effect of stake, as well as the corresponding handling fees generated by subsequent protocolUnbond, Withdraw, and other operations.

Taking the first phase of stakeWar as an example: if each transaction is limited to depositing only 0.005 BTC, and only transactions within the first 5 Blocks are valid. Assuming an institutional Validator needs to deposit 100 BTC, they would need to initiate 20,000 transactions on-chain within one hour, and these transactions must be confirmed earlier than those of other competitors. This will inevitably lead to a short-term big pump in network transaction fees, greatly increasing the cost for stakeholders. It is understood that the Miner fee rate exceeds 5%. (For reference only, please refer to the official data for specific information)

- The native BTC deposited in Babylon and its ecosystem's circulating Wrapped version BTC are not limited to a 1:1 ratio.

Since Babylon does not have a directly circulating Wrap version of BTC, the Wrapped version of BTC circulating within the Babylon ecosystem is provided by some participating Nodes, including: @SolvProtocol, @Bedrock_Decentralized Finance, @LorenzoProtocol, @Pumpbtcxyz, @Lombard_Finance, etc. These institutional Validators stake a certain amount of BTC in Babylonstake, but the actual aggregated Wrapped version BTC Liquidity far exceeds the quantity of BTC they have staked (in fact, the scale of LST Liquidity also needs to be expanded).