AirDAO launches Astra DEX, enabling seamless DeFi trading and Airdropstake reward program

AirDAO has launched Astra DEX, which will be a game changer for Decentralized Finance trading experience, providing a seamless, user-friendly trading experience and innovative one-sided Liquidity mechanism. This launch comes after a 400% surge in on-chain activity following their recent integration with Safepal.

Astra DEX - The gateway to the stars for users! Astra DEX is an infrastructure product that will serve the continuously rising user and builder community. With the expansion of the AirDAO brand Star Fleet, it will become its second important achievement. The Decentralization trading platform will seamlessly integrate with all AirDAO products, bringing users a smooth, intuitive trading experience, and integrating into their native mobile Wallet.

Users can participate in the Airdropstake event. By depositing AMB Tokens into the lock-up pool and holding them until October 2024, there will be a chance to receive generous rewards.

-

Locked AMB enjoys a fixed 10% Annual Percentage Rate (APY)

-

Exclusive Airdrop rewards from 3 native products of AirDAO:

· Kosmos - A bond market for users who want to get discounted Tokens

KOS Token: 5% of the total supply.

· ASTRA - An innovative single-sided LiquidityDecentralization trading platform AST Token: up to 5% of the total supply.

· Harbour - a liquid staking platform expected to launch in the coming months, reutilizing the use of locked assets in the ecosystem

HBR Token: 5% of the total supply.

Special incentives for Node operators: 2% of CS for each product will be reserved for Nodes that have been maintained for over 12 months. As the backbone of the ecosystem, ensuring network security is crucial.

Opportunities after the token generation event (TGE):

· Users will continue to stake and enjoy an increase in the Annual Percentage Rate to 20%, with a term of up to 12 months.· High-yield Airdropvesting: Airdropped Tokens will vest within six months, and unclaimed Tokens will automatically stake at an APR of 25% or higher.

- Reward

- like

- Comment

- Share

From Gold ETF to Solana ETF: A Look at VanEck's Success Story

Original | Odaily Planet Daily

Author | jk

The rise of VanEck, an investment firm focused on ETFs, is full of bold innovations and strategic decisions. From launching a gold ETF to the recent Solana ETF, VanEck continues to break through itself, driving changes in the financial markets. With the rapid development of the cryptocurrency market, VanEck is at the forefront of the industry, applying for a Solana ETF and opening up new investment opportunities for investors.

In this article, Odaily will delve into VanEck's founding history and its decision from gold ETFs to Solana ETFs.

History of VanEck

In 1955, John van Eck founded Van Eck Global, taking advantage of the rising international stock market in the aftermath of the Marshall Plan and the opening of Western Europe to American investors, aiming to bring post-World War II investment opportunities to American investors. His father immigrated to the United States from the Netherlands in the early 20th century. In the same year, Van Eck established the first international equity mutual fund.

In 1968, the company launched one of the first gold funds in the United States, the International Investors Gold Fund, and shifted much of its portfolio to stocks of gold mining companies. In the 1970s to mid-1980s, gold experienced a bull run, and the company achieved significant success. The International Investors Gold Fund attracted a large number of subscriptions, with assets under management exceeding $1 billion. John van Eck was invited to participate in popular talk shows at the time, such as The Wall Street Journal and The Merv Griffin Show.

1980 to the early 20th century: Low point

However, the boom in the gold market ended after the mid-1980s, and the company's business slowed down. By February 1998, the assets of the International Investors Gold Fund had shrunk to $250 million. John's son Jan said, "He became a gold bug. Basically, the value of gold has been declining throughout my career, which means you're suffering redemptions, and the fund is depreciating because the gold price has fallen from $800 an ounce to a low of $250 an ounce."

To cope with the decline of the gold market, the company began developing investment businesses in emerging Asian markets in the 1990s. In 1996, the company signed a joint venture protocol with Shenwan Hongyuan, the predecessor of Shenwan Hongyuan Group, to tap into China's fund market. However, the demand for emerging market funds plummeted during the Asian financial crisis in 1997. One of the company's funds, Van Eck Asia Dynasty Fund, saw its assets under management drop from $46.3 million at the end of 1996 to $11.2 million at the end of 1997.

From 1994 to 1998, the assets managed by the company decreased by 21% from $1.82 billion to $1.44 billion. In 1997, metal prices reached the lowest point in 12 years. Only its Global Hard Assets Fund achieved a positive return of 26% in the three years ending in December 1997. As a result, the company experienced redemptions and a shrinking client base.

After 2006

In 2006, the company decided to enter the ETF business and launched its first ETF product, Market Vectors Gold Miners ETF, which allowed investors to access the gold market through the stock market instead of directly investing in gold. Although not as popular as the SPDR Gold Shares launched in November 2004, its managed assets grew to $5 billion, becoming one of the company's largest successes. By November 2009, the company had issued more than 20 ETF products, with total managed assets reaching $9.7 billion.

John van Eck often travels abroad for business, especially in Europe. During one trip, he met Sigrid, a German woman 20 years his junior, and brought her back to the United States to marry. She later became the Chief Financial Officer of VanEck and the mother of two children. In the early 1990s, his sons Derek and Jan joined the company, and VanEck launched a series of business initiatives, with a focus on ETFs, bringing significant rise. Since Derek's passing in 2010, Jan has been managing the company's continuously rising global business, continuing to do so to this day. Jan graduated from Stanford Law School and, inspired by technology entrepreneurs, joined the family business and began the transformation of ETFs.

Jan van Eck, "My father valued economics and history very much, while I am more of a business-oriented person, which allows me to seize the opportunity of ETFs and shift towards non-active managed gold funds."

In Europe, VanEck opened its first office in 2008, focusing on index business. It then opened a Swiss office in 2010, with a focus on following institutional distribution and alternative and active investment management strategies. In 2018, VanEck acquired Dutch ETF provider Think ETF Asset Management B.V. to expand its ETF product portfolio in Europe and international markets.

On March 2, 2021, VanEck launched the Vectors Social Sentiment ETF, with the stock code 'BUZZ,' on NYSE Arca. The fund consists of popular stocks on social media. On the first day of trading, the fund received a record-breaking inflow of $280 million, making it one of the top 12 best debuts in history.

To date, VanEck has issued over 100 ETFs, managing assets totaling over $90 billion.

VanEck's successful history, image source: VanEck official website

Gold ETF and VanEck

Gold ETF is a financial product that tracks the price of gold, allowing investors to buy and sell gold shares through the exchange without actually holding physical gold. The emergence of gold ETFs has greatly simplified the process of investing in gold, dropping transaction costs and risks.

The first gold exchange trade product is the Central Fund of Canada, which is a closed-end fund established in 1961. The fund amended its articles of incorporation in 1983 to provide investors with products holding physical gold and silver.

In 1968, VanEck launched the first open-end gold stock mutual fund in the United States.

In 1971, President Nixon of the United States canceled the link between the dollar and the gold standard. VanEck's gold fund (now known as the VanEck International Investors Gold Fund) was the first of its kind, and with the price of gold soaring from $35 per ounce to $800, the fund became the best-performing fund in the industry.

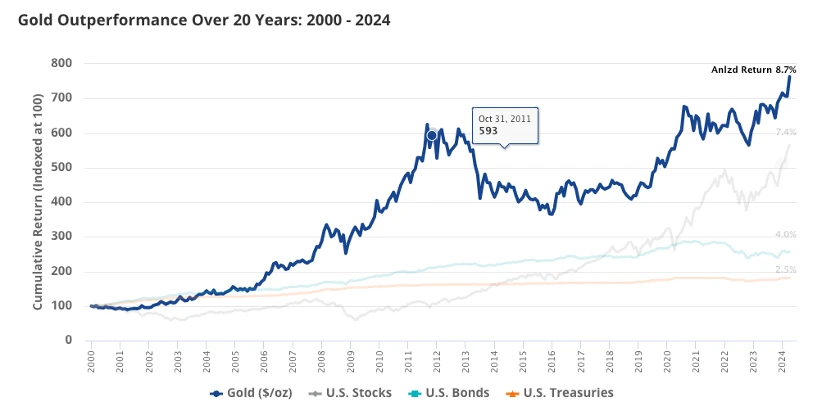

Gold performance since 2000. Source: VanEck

Although John is passionate about gold, his son Jan van Eck realized that the company's overreliance on gold is a vulnerability. He shifted the company's focus and entered the ETF field first. Today, ETFs account for 90% of VanEck's business.

On March 28, 2003, the first gold ETF developed by ETF Securities was listed on the Australian Securities Exchange. On November 18, 2004, State Street Corporation launched SPDR Gold Shares listed in the United States, and the fund's assets exceeded $1 billion within the first three trading days.

In 2006, VanEck launched its first gold ETF product, the Market Vectors Gold Miners ETF, just two years after the first gold ETF in the United States. To this day, the average volume of the ETF is around 20 million US dollars, and the total net asset management is 13.2 billion US dollars.

The VanEck of the encryption world: applying for the first BTC futures ETF, the first SpotETH ETF, and the first Solana ETF

VanEck is an important player in the well-known BTC ETF and ETH ETF. Unlike BlackRock's high approval rate, VanEck has always been labeled as the "first application, bold trial and error". On August 11, 2017, VanEck submitted an S-1 application to launch the first BTC futures ETF, becoming the first issuer to apply for an ETF investing in BTC futures. Subsequently, VanEck tirelessly applied for the SpotBTC ETF.

However, in November 2021, the US SEC rejected the application due to concerns that potential fraud in the cryptocurrency market could spill over to regulated exchanges. The application was rejected three times from 2021 to March 2023. However, VanEck persisted and finally succeeded in listing the product after the approval of Spot BTC ETF in 2024.

Afterwards, VanEck became the first company to submit a SpotETH ETF application in 2021, almost three years before the SEC began engaging with issuances including BlackRock, Fidelity, and Ark Invest.

However, unlike companies like Fidelity and BlackRock, which only stick to BTC and ETH ETFs ( BlackRock's digital asset head Robert Mitchnick publicly stated that BlackRock believes customers 'have little interest' in Cryptocurrency outside of BTC and ETH ), VanEck has taken an extra step: applying for a Solana ETF.

At the end of June, VanEck submitted an application for a Spot Solana ETF to the Securities and Exchange Commission (SEC) in the United States, becoming the first issuer to apply for a Solana ETF. In a post on platform X, Matthew Sigel, VanEck's director of digital asset research, stated, "The decentralized nature, high utility, and economic feasibility of SOL are consistent with the characteristics of other established digital assets, reinforcing our belief in the value of SOL as a commodity with utility for investors, developers, and entrepreneurs seeking alternatives to the dual Oligopoly application stores."

Coindesk stated, "VanEck is known for its pioneering position in the digital asset field."

- Reward

- like

- Comment

- Share

Why will Chain Abstraction become the next mainstream hot narrative?

Author: Haotian

Why is 'chain abstraction' becoming another mainstream hot narrative after 'modularity'? In addition to the seemingly 'empty' goal of Mass Adoption, I think the real core reason is as follows:

- Chain abstraction is inevitable after modularization to a certain stage, because the architecture of blockchain technology roughly includes consensus layer, execution layer, DA layer, interactive operability, settlement layer, and so on. Traditionally, monolithic single-chain needs to coordinate and strengthen each layer comprehensively, while modularization breaks this situation.

The DA layer, the interactive operability layer, and even the execution layer can all be singled out for performance optimization and can function in a composable collaborative manner. Therefore, 'modularity' has become the mainstream paradigm for developers seeking to build differentiated chains. This low-cost and narrative-strong approach to entrepreneurship gradually becomes mainstream without having to worry too much about long-term issues such as ecological operation.

However, modularization is essentially aimed at infrastructure construction. When excessive development efforts are overly focused on modularization, it will lead to an imbalance between infrastructure and applications, resulting in a situation where there is more infrastructure than applications.

Obviously, the emergence of 'chain abstraction' is to break the embarrassing situation, re-integrate the modularly torn blockchain components, improve the experience level, drop the threshold for user Onboard, and then promote the rise of applications. In a sense, chain abstraction will make up for the ecological and application imbalance brought by modularization and become an indispensable narrative in the next stage.

- The abstraction of the chain itself is just a general concept, which can be roughly divided into three specific implementation directions.

-

Tool services promote compatibility of heterogeneous chains, aiming to seamlessly integrate different blockchain environments and increase the proportion of applications for the services themselves. For example, Chainlink's CCIP;

-

Acting as a centralized liquidity provider and an aggregation and scheduling center, it mainly aggregates dispersed assets from different on-chain sources, using more secure and transparent Cross-Chain Interaction information transmission to build a unified liquidity layer (asset Cross-Chain Interaction, message transmission). For example, @0xPolygon's agglayer, @ProjectZKM's Entangled Rollup Network, etc.

-

Adapt to various heterogeneous chains and introduce a unified user interaction layer, build a unified contract scheduling center, Decentralization Solver service coordination center, and other unified user experiences such as unified gas payment, social login, and social recovery on the basis of a series of compatible tools or services, in order to lower the participation threshold for users, and attract more users for a longer period. For example, the BOS operating system initiated by @NEARProtocol, the Intent Solver execution network launched by @dappOS_com for popular applications such as GMX, and the account abstraction and intent fusion solution for the entire chain by @ParticleNtwrk, etc.

In general, some of these are more technical back-end services, while others focus on upgrading the user front-end experience, all in order to unify the decentralized blockchain single-chain environment and expand the user base of the blockchain application market through seamless interaction and experience upgrade.

- The 'chain abstraction' track is more favored by VC, becoming a key integration point between web2 and web3. Initially, the ETH ERC4337 sparked a wave of account abstraction Wallet development, mainly due to the entry of a group of web2 Internet executives with financing. This is the easiest area for them to understand and leverage their expertise upon entering web3. Building on the foundation of account abstraction, chain abstraction further enriches the business scope, yet it remains the main focus of individuals with rich experience and background in web2.

Compared to the purely conceptual direction of modularization, chain abstraction technology is more inclined to the lower level. The team needs to aggregate real industry resources and accumulate asset TVL and user data rise.

Compared to the modular direction of delineating the business space with 'xxxx as a service' at every turn, VC is more likely to provide a relatively objective valuation, and users can also see the value of the chain itself through objective data, thus providing a better investment valuation reference in the Secondary Market.

- Reward

- like

- 1

- Share

Enable repurchase Dividend, upgrade security module, and deeply interpret Aave's new economic model

Aave is one of the projects that I have been following for a long time. Yesterday, its governance team ACI released a draft of the new economic model of Aave on the community forum, announcing expected upgrades in the value capture of Aave Token, security mode of the protocol, and other aspects.

Regarding Aave, the author's recent article provides a comprehensive analysis of its recent situation, competitiveness, and valuation: 'AltCoin keeps falling, or is it the best time to layout Decentralized Finance'.

The author of this article focuses on this hugely influential latest proposal, mainly addressing the following 4 questions:

-

What are the main contents of this proposal

-

Potential impacts of each major content

-

The schedule and triggering conditions for the implementation of this proposal

-

How may this proposal affect the price of Aave Token in the medium to long term?

Original proposal:

1. Core content of AAVEnomics proposal

The proposal is called [TEMP CHECK] AAVEnomics update, which is in the early stage of community proposal, namely the 'temperature check' stage. It was released 15 hours ago and initiated by ACI, who can be understood as the governance representative of Aave official team. ACI is also the brain and main coordinator of community governance. Important proposals are usually communicated extensively with other governance representatives and professional service providers before release, so the probability is high.

[TEMP CHECK] The main content of AAVEnomics update is as follows:

1. Introduces Aave's current good operating status and ample financial reserves

The project is in a continuous leading position in the lending field, with income far exceeding project expenses, and the reserve funds are long ETH and stable coins, so it has the opportunity to update the economic model and initiate protocol income distribution.

2. Bad debt processing mechanism update: The original "Security Module" is gradually exiting the stage, and the new security system Umbrella is online.

Aave currently provides reserves for potential protocol bad debts, and this mechanism is called the 'Safety Module'. The reserves are currently composed of three parts:

· Aave's stake is currently worth $275 million.

· Stake Aave's native Stable Coin GHO, currently worth $60 million

· The Aave-ETH LP for stake is also a major source of on-chain Liquidity for Aave, currently valued at 1.24 billion US dollars

The newly launched 'Umbrella' security system will replace the original security module, specifically:

· The bad debt reserve of the system will be managed by the new aToken module, which is funded by users who voluntarily deposit their funds. After depositing, users will not only receive interest on their original deposits, but also receive additional security subsidies. The subsidies come from Aave's protocol revenue.

3. The new role of Aave Token and the start of protocol profit sharing distribution

The Aave stake module still exists, but Aave no longer serves as the risk reserve for stake, but has two functions:

· Can obtain the profit surplus distribution of the protocol beyond the funds needed for operation reserve, by Aave's financial team repurchasing Aave in the Secondary Market and distributing it to the depositors through community governance proposals on a regular basis.

· Staking Aave can earn 'Anti-GHO', which can be used to offset your GHO Stable Coin debt, or directly deposited into the GHO stake module, so Aave can also benefit from the profits generated by GHO.

4. Changes to the GHO stake module

The original GHO stake module needed to guarantee the overall default of the Aave protocol system, but after the change, it only guarantees the default of the GHO part.

5. Others

· Aave Token's Liquidity no longer depends on the stake module's Aave - ETH incentives, but is entrusted to the ALC (Aave Liquidity Committee)

The conversion of the first generation Token Lend of the protocol to Aave will be terminated, and Tokens that are not exchanged in time will be transferred to the national treasury.

Aave's new economic model relationship diagram is visible:

2. Impact of this proposal

The main impacts are twofold:

Aave Token has a relatively clear value capture, and the selling pressure further drops, further linked to the good development of the protocol

· Value capture comes from: protocolInterest Spread part of the income buyback + GHO Interest income feedback

· The decrease in selling pressure comes from: the deactivation of the stake module, which also means that Aave will use stablecoins and ETH as expenditure tokens for protocol income, instead of producing Aave tokens, which will directly reduce the selling pressure of Aave and make Aave more scarce.

The introduction of the Umbrella Security Module makes the structure of the protocol more flexible, further optimizing the incentive of the protocol, further enhancing the upper limit of the protocol's security governance, and proposing higher governance requirements:

· The original Aave security module is solely based on Aave emissions for incentives, with little flexibility, while the Umbrella security module is similar to Eigenlayer's AVS mode, a modular, customizable incentive module based on asset class, time, and capacity.

· This also means that Aave's risk team has added another indicator that needs to be evaluated and formulated, in addition to risk indicators such as asset size, Interest Rate curve, and LTV.

3. Schedule and Prerequisites for Implementation

ACI stated that the implementation of the plan will be carried out gradually in three phases (three governance proposals) based on different preconditions.

Phase One: Stake and GHO Mechanism Modifications

· GHO stake is only responsible for the bad debt guarantee of GHO debt.

· Aave and Aave - ETH stake module has been changed to "Legacy Security Module", and continues to provide collateral function before being replaced, Aave stake's cooldown period is set to 0

Prerequisite: Achieved

Execution time: This proposal has obtained sufficient community opinions and has been approved by BGD Labs, the main community developer of Aave, after the Umbrella upgrade.

Phase Two: Aave Token functionality update, new economic model gradually launched

· End stake Aave to receive GHO Interest

· Discount function Anti-GHO function online, stake Aave can get Anti-GHO

· Close Lend to Aave exchange

Prerequisite:

· GHO has reached a scale of 175 million (currently around 100 million)

· GHO's secondary Liquidity can achieve 'a trading volume of 10 million with a price impact of less than 1%'. Currently, the trading volume that affects GHO's price by 1% is around 2.1 million.

Phase 3: Aave Fee Switch Activated, Buyback Initiated

· Close traditional security module

· With the aToken mode activated, users can use their deposits as collateral for the system and receive additional rewards.

· Aave financial service providers initiate Aave repurchases and allocate them to Aave stakers through governance, gradually achieving automation.

Prerequisite:

The average asset net value of Aave's income pool in the past 30 days is sufficient to cover the expenses of existing service providers for 2 years.

*Currently, the total assets in the Aave treasury excluding Aave Token are approximately $67 million (61% stablecoins, 25% ETH, 3% BTC), and Aave's annual expenditure in 2024 is about $35 million (data provided by the ACI leader). If the expenditure level in 2025 is similar, the two-year expenditure will be $70 million. Considering that Aave's weekly income has been basically between 1-2 million US dollars since this year, the two are already quite close and can reach this level in about a month.

Composition of Aave's treasury funds, source:

Aave's protocol income, source:

· The annualized income of the Aave protocol in the past 90 days has reached 150% of all protocol expenses from the beginning of the year to the present, including the buyback budget of AAVE and the expenditure of the umbrella security module.

*The budget is defined, allocated, and adjusted quarterly by Aave Finance service providers.

In general, Phase 1 is already ready to go live, and Phase 2 is expected to take a few more months (specifically depending on the Liquidity Committee's budget and investment intensity for GHO's Liquidity). The timing of Phase 3 going live is difficult to predict, as it is influenced by specific budget plans, market conditions, and income factors, but considering Aave's strong revenue level at present, meeting the standards shouldn't be too difficult.

Four, how will this proposal affect the price of Aave Token in the medium to long term

In the long run, the proposal explicitly links the development of the Aave protocol for the first time with the Aave Token, providing a buyback floor for the Aave Token and cash flow income for holders, bringing Favourable Information to Aave's price.

However, considering that the implementation of the proposal takes time and is carried out in batches, coupled with the fact that the proposal was just released less than a day ago, there is still a need for discussion and modification on specific terms, so the value capture of Aave Token is a gradual and long-term process.

However, if the proposal is successfully implemented, Aave, as one of the largest Defi projects at present, may further gain favor from value investors with its standardized and transparent governance, and rewards for Token supporters. These investors may come not only from the crypto world, but also from newcomers in the Web3 field originating from the TradFi sector.

- Reward

- like

- Comment

- Share

Viewpoint: August may become the major turning point for the encryption market

Author: Digital Asset Research

Compiled by Peisen, BlockBeats

Editor's note: Digital Asset Research demonstrates the high probability of significant events or news occurring from August 6th to 12th through detailed data on the long aspects such as time range, price range, and time perspective. The article also compares the current market cycle with previous cycles, points out the time rules of market trend changes, and provides ample evidence combined with monthly and weekly chart analysis.

This is something I have been openly discussing for some time, but today I want to reiterate that there is evidence to suggest that there may be significant trends and emotional changes in the BTC and broader Cryptocurrency markets between August 6th and 12th.

Several months ago, I mentioned this time frame in the video outlook, which you can find here.

Today, I will present all the evidence gradually built based on the time range, price range, and time perspective. I think you will see a high probability of significant events or news occurring within this time window.

We will start from the monthly chart and go all the way to the daily chart to demonstrate the convergence of multiple factors that we see.

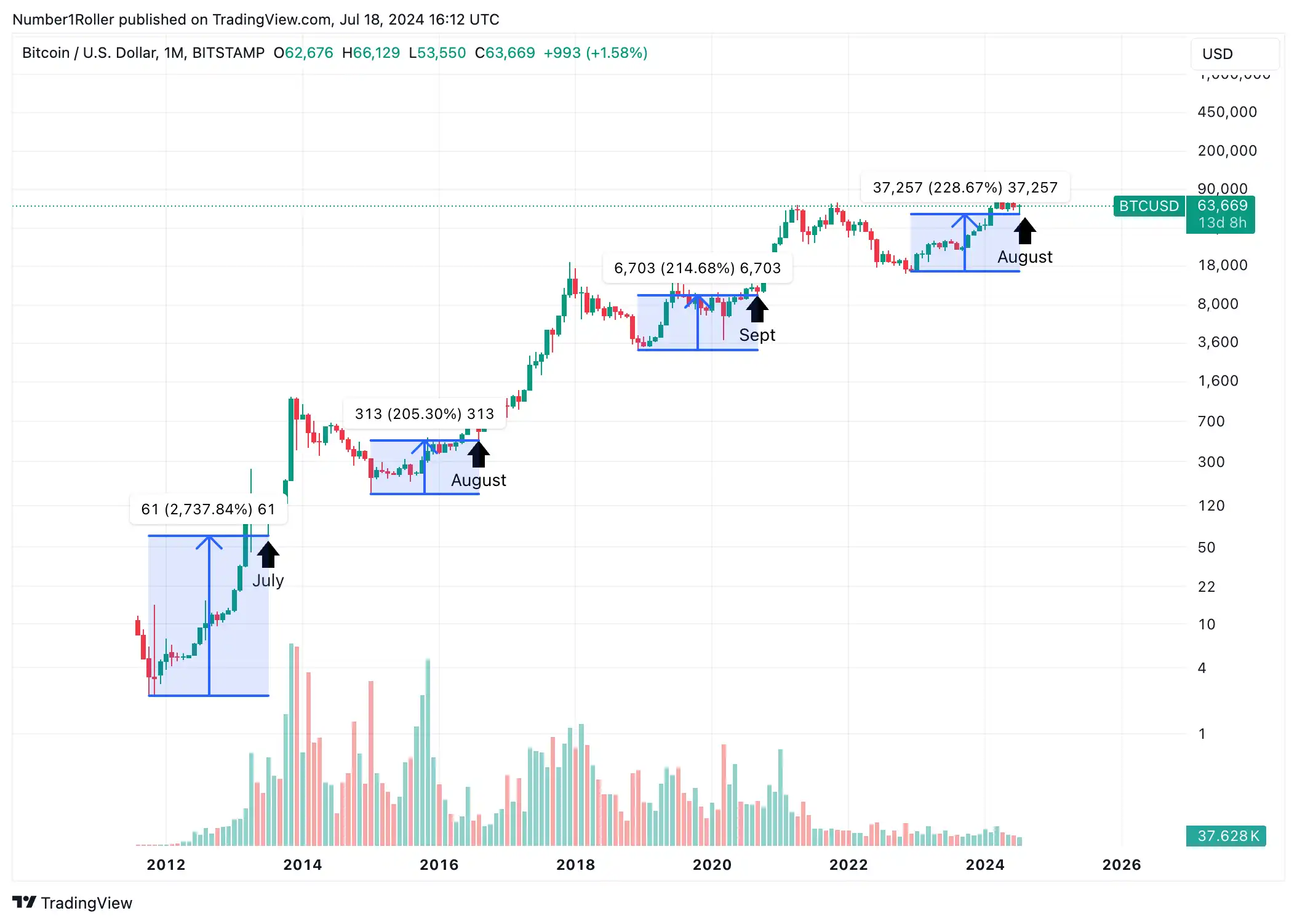

The monthly chart is the content we focused on following last week, but to further prove that we are in the same cycle, we also included the months of the previous two tops. As you can see, the previous two cycles are almost identical to the current one. The 33 months from the major high and the 20 months from the major low will place us in the time frame from July to September, which is the final low before a significant pump.

Now we know that time is on our side, but many people think this cycle is different because prices quickly reached historic highs. However, let's compare the current cycle to previous ones on a monthly chart.

The evidence is quite shocking. As you can see, except for 2012, the price in the first two cycles pumped just over 200% from the Bear Market low point, exactly at the time we are in now. You can see that this time is no different. In fact, time and price are exactly where they should be, neither overly extended as some commentators have said, nor beyond expectations.

Next, let's look at the weekly chart, there is more long content to discuss. First, we found that there is a major trend change every 30 weeks in this cycle. Interestingly, this 30-week cycle happens to fall between a major low and a major high, occurring at the same time. I will explain the reason in the next few charts, but for now, the next 30-week cycle happens to fall on the week of August 12th. The sum of these three 30-week cycles, counting from the Bear Market low, is exactly 90 weeks.

In addition, zoom in on the weekly chart. I noticed that from the high point in 2017 to the first significant high point in 2021, it took 174 weeks. August 12th will mark 174 weeks from the significant high point in April 2021, undoubtedly an important high point. Therefore, we are approaching the same time period between two important turning points, the high point in 2017 and the high point in April 2021.

Now, based on our evidence, the market is in a different phase, and in my view, the inflection point is more likely to occur in the form of a major low rather than a major high. But as I have always said, we often see a major high and low in this time window during these cycles.

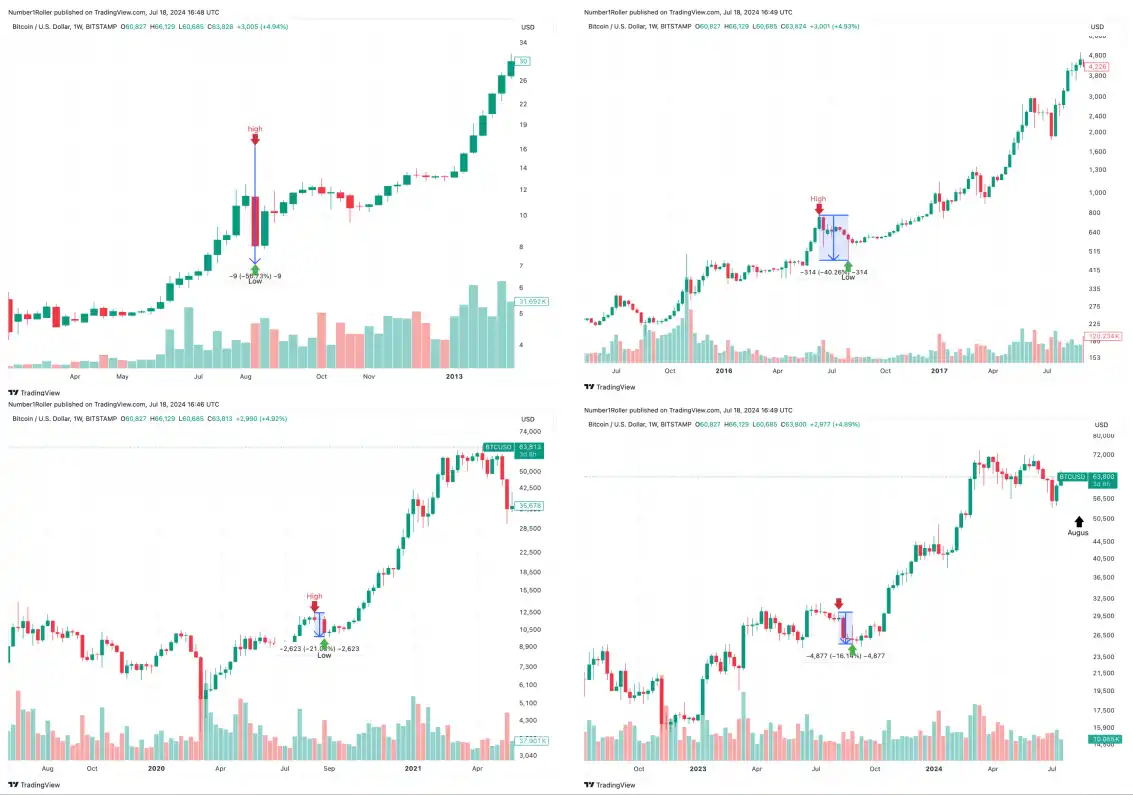

The chart below shows this particular period in each cycle, as well as the situation at this time of year last year. As you can see, there is almost always a sharp pump in August, followed by a rapid decline, which can reach 20-50%. Unlike the other three charts last year, it was only in the second year of the cycle, but it showed the seasonal feature of this type of trend occurring in August.

It also shows that significant highs and lows appeared in the market around the 30-week turning point during this cycle, with a relatively tight time window.

Now let's take a look from a time perspective. Simply put, the time perspective refers to starting from a significant high or low point and calculating 30 calendar days to find trend changes. You just need to start with 30, then add 30, 60, 90, 120, 150, 180, etc., and look for trend changes at these time points. The more concentrated the time points, the higher the importance of that day or week.

As shown in the chart below, all of these time measurements fall within a window of time angle. Within this period, we have several major highs and lows all pointing to the second week of August as a major convergence period.

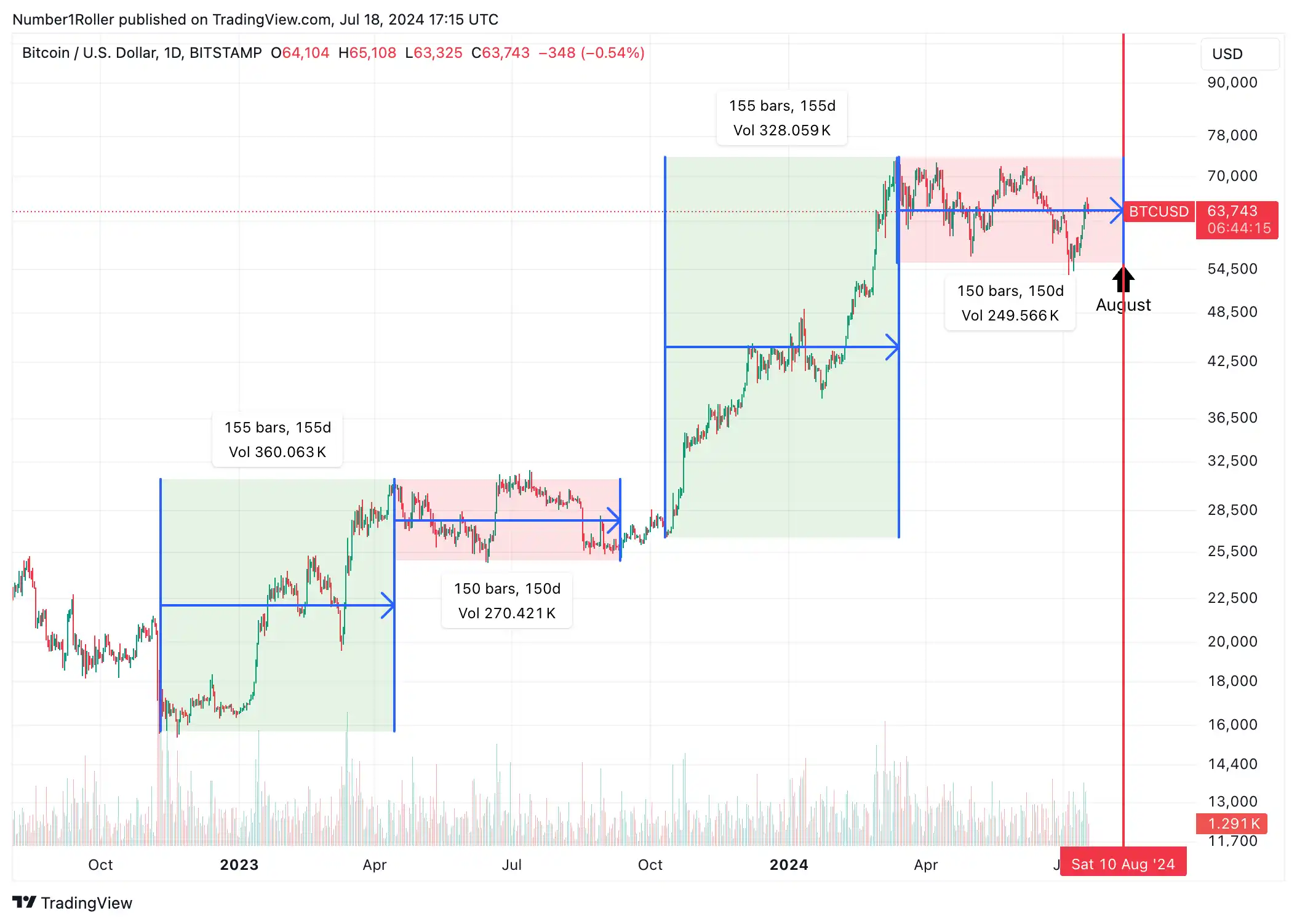

Finally, from a time range perspective, the market has always followed a 150-day cycle pattern in this cycle: 155 days of pump and 150 days of consolidation. It is worth noting that the balance of market time should not be imbalanced. That is to say, the number of days the market falls should not exceed the number of days of pump. In a Bull Market, the time of market pump is usually longer than the time of decline, as shown in the chart below. If the number of days of market decline exceeds the previous 150 days and a new low point appears, this will not be a good sign.

Finally, taking into account the price range, time range, time perspective, and seasonal factors, we are approaching a mid-August window that could very likely be a trigger point for BTC. If this evidence is not sufficient, please note that the start date of the BTC chart is August 19th. I won't go into too much detail on this issue, but the birth date is significant, and August is typically the month when the major bull market begins.

This is why I am cautious here and waiting for the window to close before taking more aggressive action. Will we see ETH ETF finally start trading, followed by a rapid drop like BTC ETF? Or will we see more long political headlines causing election uncertainty? I'm not entirely sure what it will be, but it's definitely a period worth following and being patient with.

- Reward

- like

- 6

- Share

Analysis of the pros and cons of pump.fun for the Solana ecosystem: poison or antidote?

Original|Odaily Star Daily (@OdailyChina)

Author | Wenser (@wenser2010)

On July 24th, pump.fun, a Meme coin issuance platform in the Solana ecosystem, has surpassed the milestone of 70 million US dollars in cumulative revenue, becoming a phenomenon in this cycle. The subsequent discussion is about whether pump.fun's impact on the Solana ecosystem is good or bad. Supporters believe that the pump.fun has brought the Meme coin craze to the Solana ecosystem, attracting funds, traffic, and developers to enter; opponents believe that pump.fun brings more Rug eyewash, network congestion, and garbage Meme coin to the Solana ecosystem. Odaily Star Daily will briefly analyze this in this article to provide readers with a more comprehensive perspective on this matter.

pump.fun: a product of the times that creates heroes

At the beginning of May, the new issuance of SPL Tokens in the Solana ecosystem reached a record high, reaching 14648, with the main driving force behind this achievement coming from pump.fun, with the new issuanceToken accounting for over 50%. At that time, pump.fun was seen as a 'one-click coin issuance platform', with relatively few 'gold dog Meme coins', but it has already attracted a lot of market follow. Nanzhi, a senior author of Odaily Star Daily, has also provided a comprehensive introduction to this, see the article "The engine behind the historical high growth of Solana's Token issuance, interpreting the rise engine Pump.fun" for more details.

Looking back at the development history of pump.fun, important Nodes include the following:

- In mid-March, the Meme coin craze led by BOME and SLERF injected new Liquidity and market attention to Solana's ecosystem, and also laid the foundation for the explosive rise of subsequent Meme coin projects.

- In May, pump.fun suffered a Flash Loans attack, with 1.2 million US dollars stolen. It was later found to be done by a former employee (for details, please refer to the article 'How did the former employee steal 1.2 million US dollars and the pump.fun theft event is so long?' by a senior author of Odaily Planet Daily). Despite facing a Crisis of Confidence at one point, the project still managed to overcome this challenge through proper handling. Subsequently, it also launched a live streaming feature and ushered in the 'Meme Coin New Media Era.' Recently, the 'Recommended for You' information flow feature has also been launched on the platform.

- In early July, the number of tokens released on Pump.fun has exceeded 1.17 million, with a cumulative income of over $50 million. On July 1st, it achieved a new achievement of "income of $1.99 million in the past 24 hours", surpassing Block chain networks such as ETH, TRON, Solana, and ranking first in DefiLlama protocol income for a while.

Thanks to the active Meme coin projects on the pump.fun platform, the Solana ecosystem has become the "only ray of light" in the volatile market in recent months -

- On June 24th, according to data from SolanaFloor, the total on-chain DEX volume of Solana exceeded 400 billion US dollars, with a total number of trading users exceeding 20 million, and a Swap volume of approximately 1.59 billion transactions.

- On July 22, DeFiLlama data shows that Solana on-chain DEX has a volume of 145.97 billion US dollars in the past 7 days, ranking first for three consecutive weeks, with a 7-day increase of 9.73%.

- On July 24th, according to Blockworks Research analyst Ryan Connor, Solana has surpassed Ethereum for the first time in the past 30 days in terms of Decentralized Exchange (DEX) volume. By this measure, Solana has become the most commonly used chain.

It can be said that the achievements at the data level cannot fully reflect the value of Liquidity, attention and influence brought to the Solana ecosystem by pump.fun. In a certain sense, pump.fun has become the engine that supports the "ecosystem Bull Market" of Solana.

But behind the prosperity of flowers and the boiling oil, pump.fun has also infiltrated every aspect of the Solana ecosystem like a 'poison'.

pump.fun: The culprit of ecological decay and rapid decline

As the saying goes, 'what makes you successful can also limit you.' The promotion of pump.fun in the Solana ecosystem is obvious, but there are also many negative impacts. Specifically, the main negative impacts include the following points:

Rug scams are rampant, and there are countless eyewashes

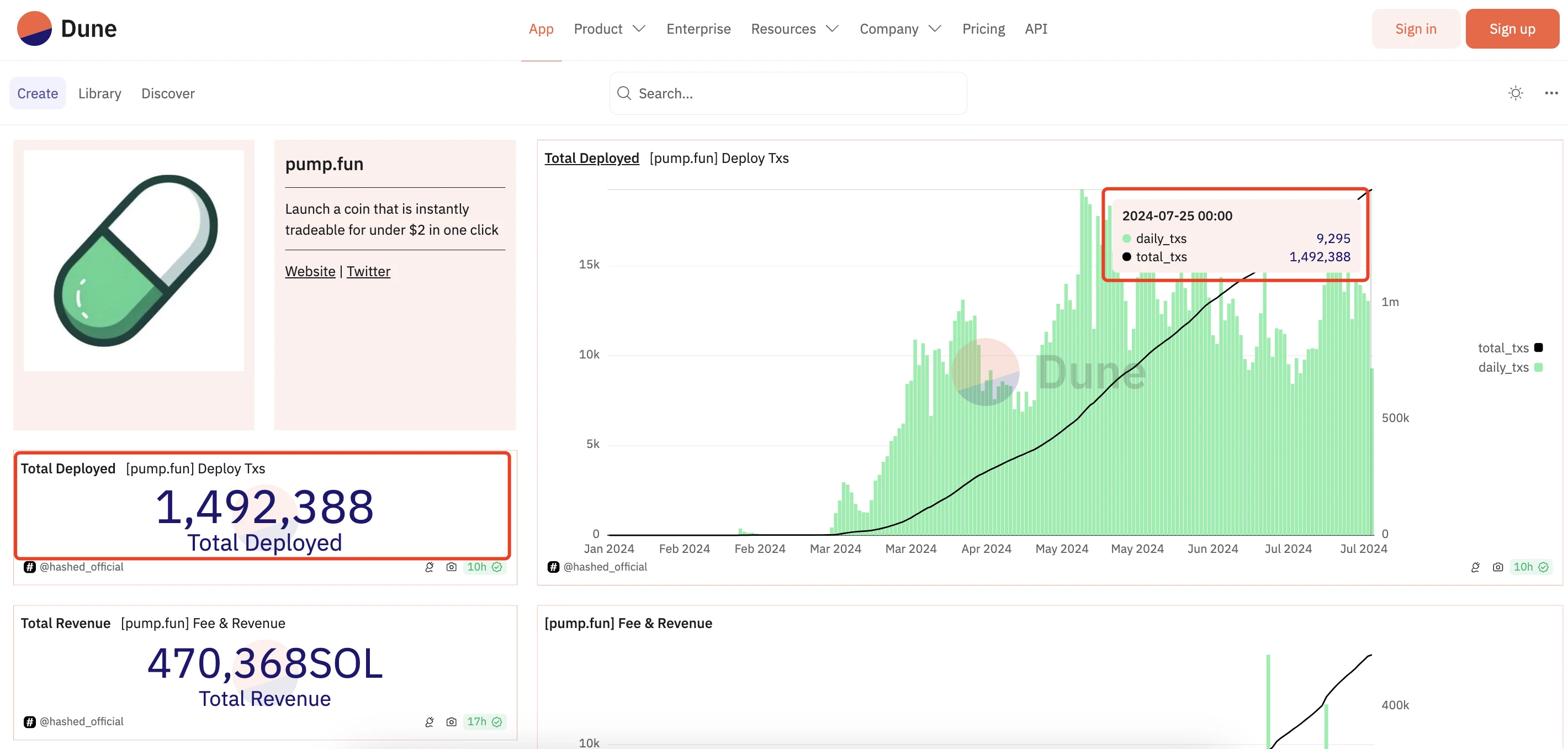

According to Dune's statistics, the issuance of the Meme coin project on the pump.fun platform has nearly reached 1.5 million, and in such a large number of projects, there are still many barriers to overcome:

Only when a project reaches a $69,000 Market Cap will the platform add $12,000 Liquidity to Raydium (a leading Solana DEX) and burn LP tokens. After that, reaching a $100,000, $200,000, $500,000, $1 million, or even $10 million Market Cap becomes a milestone for these Meme coin projects. Any slight mistake can result in a total loss. Only a few projects, such as BILLY (internet memes dog), have achieved the milestone of surpassing a $100 million Market Cap. Naturally, the extremely low coin issuance threshold has also given rise to countless Rug eyewash scams.

pump.fun related data

Celebrity Coin Arena, pump.fun is a new platform for harvesting

According to the statistics of encryption KOL Slorg, the market capitalization of 30 famous Meme coins with certain attention on the market has dropped by at least 80% in just a few days to several tens of days. Pump.fun provides the most convenient tool for these celebrity coins, to some extent becoming an accomplice in the "harvesting" of celebrity coins.

Slorg's related statistics on celebrity coin Market Cap

Eye-catching, showing the lower limit, or triggering extreme and negative events

Previously, after pump.fun launched the live broadcast function, it caused a high degree of market follow-up. Earlier, a developer named Mikol launched a Meme coin called TruthOrDare (DARE) on Pump.fun in May, and later accidentally caught fire due to alcohol ignition during a Twitch live broadcast and suffered third-degree burns all over his body, leading to hospitalization; previously, a Meme coin project named 'LIVEWITHMOM' had a live broadcast of a certain minor and 'mother' based on the rise and fall of the coin price and barrage requests, involving some naked body privacy. It must be said that once the Meme coin project goes crazy, it is easy to cause a series of uncontrollable events.

LIVEMOM PROJECT LIVE STREAM

In addition, pump.fun has led to the Solana ecosystem's Meme coin project becoming more and more 'PVP', with a project being able to go straight to zero in just a few minutes, and the presence of MEV extractors and various sniper bots has also left the Solana ecosystem unable to extricate itself from a 'drastic surge to quench thirst', in the long run, the attention of legitimate projects and Liquidity will also increasingly wither away.

Summary: pump.fun will continue to exist in the form of a 'casino', but the platform determines its lifecycle

Overall, pump.fun is more beneficial than harmful to the Solana ecosystem. As mentioned in the previous article 'One-click issuance becomes the 'encryption' of new passwords', one-click issuance platforms have become important tools to facilitate ecosystem development, and many similar projects are striving to establish their own ecological positions on different blockchain networks.

Therefore, as VC coins become less popular and BTC Spot ETF and ETH Spot ETF are listed one after another, pump.fun will continue to exist in the form of an on-chain casino, attracting more and more long-term participants due to its high liquidity and attention.

But if the platform cannot respond to seeking reasonable ways to limit Rug discs, eyewash, and avoid extreme events, it may also encounter "traffic backlash" one day, and be mercilessly abandoned by the ecosystem and the market. This may also be one of the reasons why Solana officials recently promoted functions such as Blinks.

**For now, we can only say that 'Liquidity is the most honest manifestation'.

- Reward

- like

- Comment

- Share

Besides Trump, which other American politicians will attend this year's BTC conference?

Bitcoin Magazine CEO David Bailey confirmed yesterday that US Vice President Harris will not speak at the BTC 2024 conference. Despite Harris's absence, this year's BTC conference is not lacking in the presence of American politicians. The conference has invited 10 American political guests including Trump, with 8 being Republicans, only one being a Democrat, and one being an independent (former Democrat).

Of course, it is not surprising. On the one hand, Nashville, where the conference is held, is located in Tennessee, a traditional 'red state' and the stronghold of the Republican Party, both senators from Tennessee will attend. On the other hand, compared to the conservatism of the Democratic Party, the majority of the Republican Party have an optimistic attitude towards Cryptocurrency. A recent survey by Paradigm showed that 28% of Republicans hold or have purchased Cryptocurrency, which exceeds the national average, and 60% of Republicans tend to have clear encryption regulations in Congress. An intuitive comparison is that in May of this year, the Republican Party led and pushed through the FIT21 bill, the following figure intuitively reflects the voting results of the two parties and their attitudes towards the regulation of digital assets. Recently, the Republican National Convention also approved a new policy proposed by Trump for the Republican Party, one of which is to support innovative encryption policies.

The voting situation of the two parties on the FIT21 bill, source: Bitwise

Let's go back and talk about the politicians who participated in the BTC conference and their promotion of encryption.

· Donald Trump: 2024 US presidential election candidate, former 45th President of the United States, Republican. He referred to himself as the 'Crypto President' and has been involved in the encryption field. You can read about his involvement in our previous article, 'Selling Trump: The former president's encryption political and business circle and 'business experience'.'

**· Vivek Ganapathy ** has participated in the Republican nomination campaign for the 2024 U.S. presidential election, a Republican who announced accepting BTC as campaign donations during the campaign. He announced his withdrawal from the presidential primary on January 15, 2024.

· Bill Hagerty is a Republican senator from Tennessee who has criticized the Democratic Party for being too centralized and restrictive in their treatment of the encryption industry.

· Marsha Blackburn is a senator from Tennessee, a Republican. She announced during this year's reelection campaign that she would accept Cryptocurrency donations and praised the freedom and privacy of BTC.

· Cynthia Lummis is a senator and former federal congresswoman from Wyoming, a Republican, and a supporter of BTC. She has been pushing for legislation related to BTC and cryptocurrency, stating that BTC and cryptocurrency will become an important part of the future economy. She also plans to announce BTC strategic reserve legislation at the BTC conference.

**· Tim Scott ** is a senator from South Carolina, a Republican, and a member of the US Senate's Financial Innovation Core Group. He has repeatedly called for a balanced approach to digital assets and advocated for the establishment of a Cryptocurrency regulatory framework.

· Bernardo Moreno is a Republican candidate for the United States Senate, a Republican, and a blockchain entrepreneur and Cryptocurrency enthusiast.

· Sam Brown is a Republican Senate candidate, Republican, early adopter of cryptocurrency, who invested in BTC in 2017.

· Robert F. Kennedy Jr. is an independent candidate for President of the United States, formerly a Democrat until 2023, and currently affiliated with another independent party. He has purchased 14 BTC and has made multiple statements in support of the Block, BTC, and Cryptocurrency, such as expressing the desire to allocate the entire U.S. budget to the Block on-chain and promising to release the founder of the Silk Road platform if elected president.

**· Ro Khanna ** is the only Democrat at the conference, who has been a member of the U.S. House of Representatives since 2017. This congressman is a progressive Democrat, representing a district in Silicon Valley that is friendly to Cryptocurrency. The highly followed Cryptocurrency policy roundtable this month was hosted by Ro Khanna, who has been in contact with senior executives in the digital asset industry, Democratic lawmakers, and White House officials.

P.S. Despite encryption becoming a battleground for both parties and Favourable Information for the entire industry, in the long run, both parties need to cooperate more in promoting the development and regulatory aspects of the encryption industry, which is healthier for the entire ecosystem.

- Reward

- like

- 4

- Share

Ethereum ETF Excitement Shelved: Bitcoin in the Spotlight Again with the Trump Effect! - Coin Bulletin

Crypto analysis firm QCP Capital has published a market report for July 23rd.

On July 23, Telegram, QCP Capital shared a cryptocurrency market report. The report includes the fate of spot Ethereum ETFs and the market's movement based on expectations of Donald Trump.

Analysts pointed out that after the launch of Ethereum's ETF, it fell from $3,563 to $3,086, similar to the spot Bitcoin ETF launch in January.

Analysts from Grayscale fund expressed that the outflows will continue to affect spot Ethereum ETFs for a while, emphasizing that the market is in a classic 'buy the rumor, sell the news' game.

However, it was noted that spot Ethereum ETFs without staking feature may never be able to capture the expected enthusiasm.

Trump expectation in Bitcoin options market

QCP stated that Donald Trump's speech at the Bitcoin 2024 conference on July 27th has created excitement in the options markets, and also noted that the possible decision of the FOMC next Tuesday has stirred the markets.

These expectations have led to a rise in long positions for large funds for the 2nd of August maturity throughout the week:

After experiencing the 'Trump Effect' last weekend, the options market is expecting a massive fireworks display with volumes expiring on July 28 priced at 85 vol.; almost twice the actual volumes.

- Reward

- like

- Comment

- Share

Web3 Handwritten Report: Industry Hotspots and Explosive Products Not to Be Missed This Week

Original author: VIKTOR

Original translation: Peng SUN, Foresight News

GCR is an anonymous trader who rose to fame during the 2021 Bull Market for seemingly having a great grasp of market trends. As a well-known Short master with massive trading volume, his trading cases are impressive. For example, he openly shorted the top of DOGE in May 2021, shorted SHIB and Metaverse tokens in November 2021 (the peak of the Bull Market), and openly shorted LUNA before its collapse in 2022 (he made a $10 million bet with Do Kwon). Although he now speaks less frequently on social media compared to the last Bull Market, we can still read through his past tweets. This article has compiled some valuable insights worth saving and rereading.

Before reading the GCR tweets, I summarized and extracted some valuable points from the GCR perspectives worth learning:

-

The integer barrier is the Schelling point, which is either a potential support point or a resistance point, especially when there is no valuation reason.

-

Low unit deviation can attract retail investors: When you have millions of dogcoins (which are 10,000 times smaller than 1 USD), why would you buy less than a tenth of a bitcorne?

-

Do not short low Market Cap projects: if GCR follows this rule, you should do the same.

-

The strong always get stronger, and vice versa. Reducing the number of winning combinations and increasing the number of losing combinations is a bad strategy. It is better for you to go against the tide.

-

From the SNL and Musk's performance, Shorting every DOGE pump is one of the most successful trades you can take.

-

The advantage of GCR has nothing to do with K-line analysis or any complex strategy, it only relies on intuition.

-

Compared to the old Token, the new Token has one advantage: full of hope, lacking holders.

-

The market's reaction to news provides much more information about market participants' biases (bullish or bearish) and emotions than the veracity of the news itself.

-

Don't overthink it, just focus on making money.

-

During the altcoin cycle, you should maximize risk at the beginning and gradually reduce it over time, but most people do the opposite.

-

Asia/China will drive the next Bull Market.

-

BTC and ETH are both at the bottom. GCR turned bullish after the FTX crash.

-

Most people with long-term beliefs are better off holding BTC and ETH, rather than trading.

-

ETH will reach $10000.

Note: GCR was originally tweeted by @GiganticRebirth account, now using @GCRClassic, and there are also several tweets from the temporary account of GCR "MingXMecca".

Long-term, every time there is panic dumping due to Decentralized Finance vulnerabilities, because the market actually never cares about more than a few hours of time.

The market's reaction to news is very valuable for reference:

When news affects prices, market participants often struggle with whether it is true or false. More often than not, the actual truthfulness of the headline news is not important. The market's reaction to the news, and its reaction over a long period of time, is more meaningful.

**「Reverse Selling News」: **

When 95% of traders expect to 'sell the news' after the news is confirmed, I almost always buy, as I have said in the past, 'Reverse sell the news'. Many people who were forced to leave out of fear of a certain event are forced to rejoin. 'Selling the news' happens in unexpected circumstances.

Do not short low Market Cap projects:

That's why we never, never, Short low Market Cap projects. This is one of the hard rules I teach everyone, especially when sellers are exhausted after four years and supplies are in desperate straits.

Intuition is the greatest advantage:

The best traders will always put intuition first, not apophenia. Don't like this answer? Intuition is not enough to satisfy your curiosity? This is the truth, there is no other truth. I can't teach it to you, but you can find the edge.

Low unit bias effect can attract retail investor:

No matter how many times they see it, people still underestimate the attractiveness of the low unit bias effect on retail investors. This is the most powerful magnet in Cryptocurrency. Why would any sober-minded person buy 100 CONE, while retail investors would own 1,000,000? This is the cheapest Token on Coinbase.

Don't think too much except for making money

DOGE is the easiest coin to trade through the pump driven by catalysts:

Once you completely detach from these short positions, you will find that DOGE is the most easily tradable token. On April 20th, DOGE day, Musk appeared on the comedy show "Saturday Night Live" (SNL), and TSLA accepted DOGE payment. I shorted all the tops, and the enthusiasm for pumping can never meet expectations (a meme Token should not strive for fundamentals), and there may not be a cyclic low point.

Why profit from shorts?

The third most common question I receive is: If you still believe they will continue to decline in the long run, why profit on shorts? If you get a 70-90% drop space when shorting an AltCoin and still hold an extra 10%, please reassess your heuristic. If you're still mimicking my shorts discourse months later, this will happen to you.

shorts can be a type of trade or a type of contrarian investment:

There are two ways to shorts: trading and contrarian investing. If the confidence interval for the 1-year price is > 95% (there is a 95% chance that the price will be lower than the current one year later), it will "invest" and will not follow the short-term Fluctuation. I chose to "invest" in PEOPLE with 0.09 USDT; Squeezing into ATH is possible, but my investment is in a great company.

The Future of Non-fungible Tokens:

Comparing the Market Cap of Non-fungible Token projects with some famous meme Tokens: SHIBA reached a peak Market Cap of 60 billion; no Non-fungible Token has a cap of 1 billion USD (except BAYC). Relative to the rise of Non-fungible Tokens, AltCoin 2.0 seems to be overvalued; I predict that the tokenization of Non-fungible Tokens will erode the volume of AltCoin 2.0.

Hard integer throat is Sherrin point:

As expected, Rebound came out of 10 meme supports, but not entirely internet memes; hard integers are the obvious convergence point of fuzzy valuation of reflexive assets; Respect Xie Lin point.

Zone Rotation and Imitation:

For weeks I've been telling everyone that the biggest threat to any successful project is its own success. Success breeds imitation, and in this profit-driven industry, it will mercilessly shift to the original Derivatives to chase higher returns (from VC to traders to the final retail investor).

Decentralized Finance Summer, Food Farms, Original seigniorage [ESD, DSD], OHM (Olympus DAO), and countless other hot trends are rotating.

Short Elon Musk Stimulates DOGE Pump:

Has there been any trading strategy in the past year that is easier, more accurate (over 100%?), and less complicated than shorting Elon Musk to pump DOGE? A trade that requires less advantage, better predictive ability, and less talent, but always works? SNL, Dog Day, TSLA payments, Super Bowl ads, space missions, and so on.

Do not attempt to catch the bottom:

If I have helped you in the past, please listen to my advice: don't try to catch the bottom. You may incur huge losses, thinking that you can buy at a low price and recover some of the losses. This is almost impossible, and you are very likely to panic dump due to losses, or the currency price may go to zero.

Mastering Airdrop Chart Patterns:

Capturing (the) high volatility on both ends is where you can achieve the best returns, but the market has become increasingly efficient in pricing these events. However, Airdrops still often follow predictable chart patterns that the market has not fully mastered; study everything that has happened in the past 18 years.

Mastering the timing of Airdrop "bottom" is actually a very crucial art form that needs to be learned in this field; I really started studying this issue after UNI. Sometimes on-chain indicators are helpful, but this is in exchange; once the price flattens out and starts consolidating, sellers are usually exhausted.

Devote fully in interpersonal networking:

If you are not good at trading, you can try your best to build a network of contacts. Attend every meeting. Show up at every gathering. In a Bear Market, it is easier for humans to connect. You won't believe how many people I know who have succeeded by knowing the right people.

The famous 'Decentralization Casino' paper:

Just as 'digital gold' became the narrative and use case winner of BTC in the last cycle, the argument of 'Decentralization Casino' is becoming the Consensus of the entire encryption industry (filling the gap left by 'Web3').

For ordinary people, it's too expensive to fly to Macau or Las Vegas. When we have windfall gains and macro risks, Decentralization casinos and/or Decentralization Ponzi Schemes always run the fastest. I have always believed that humanity is desperate, greedy, corrupt, lonely, and trapped in the metaverse.

News Trading:

If you find yourself marginalized, I would suggest you trade the news instead of getting information from others. The competition for news trading is getting fiercer, so you must establish a fast-reacting infrastructure and observe projects that have been delayed for several months.

The most important thing is that if you are trading meme coins, when the market shows that they don't care about the 'news' of memes, you need to quickly cut your losing combination. Any traders who have an intuitive sense of the market can clearly feel this catalytic emotion and should take some profits at the first impulse.

The relative strength of stocks is often a lagging effect:

Traders often contact me asking why Crypto shows relative strength or weakness compared to stocks. I usually tell them to wait before drawing conclusions; most of the time, we are just witnessing a lagging effect.

GCR Short了一些coin:

Shorting SHIB, DOGE, GAL, SAND, MANA, original LUNA, LUNC publicly, and more generally, the Cryptocurrency bubble of the entire 2020-2021 and the macro-asset bubble lasting 10 years in the fourth quarter of 2021.

To be honest, due to some 'future catalysts', Token with Heavy Position of retail investors is often hyped for several months, leading to an explosive buying frenzy as the event approaches. Just when retail investors imagine that MEME will make them millionaires, market makers use the eventual Liquidity chain reaction for distribution.

Betting Unit Bias:

What caused XRP to rise to $3? The most important thing is the low unit deviation. BTC is already $10,000, ETH is $1,000. Retail investors feel that they are late to the game, but can XRP, which is priced at 10 cents, rise to $1? $10? How about $100? There is a lot of speculation that Coinbase will soon go public (which is not true) and betting on unit bias in the next cycle.

What really drives the development of retail investors in the AltCoin cycle? (1) I got into the 'legitimate asset class' (BTC/ETH) too late; (2) other coins seem to be institutional as well (XRP will be used by banks, Garling seems to be certified, ADA was created by the 'co-founder' of ETH, Musk endorses DOGE).

In the middle to late stages of the cycle, they start chasing the more decadent games that don't need so long societal proof (because the pool of retail investors has opened up). These cycles only start after the main assets have pumped for a long time, leading to (1) wealth effect; (2) people feeling they have missed the opportunity and chasing after altcoins.

For most people, it is too early to consider the next "institutional" coin. Doing research in a Bear Market will give you an advantage, but the real time to invest is after a significant pump in the major market. Emotions will also change from Cryptocurrency is an eyewash to "I need to buy the next ETH, ETH is too high".

Advantages of the new coin:

Full of hope; lacking holders; the team is not very rich, lacking motivation to speculate.

China and Asia will drive the next bull market:

I believe that China (and Asia as a whole) will provide the driving force for the next Bull Market, which will take quite some time to digest the Western ridicule of this space. However, the East is rising and eager to showcase itself. You should take a look on WeChat, where many future high-rises will be on Tokens that you are not aware of in your circle.

Strong Always Strong (MingXMecca):

In the narrative cycle, we have a cognitive bias towards buying Tokens that have not yet risen; but in the long run, the strong always get stronger, while the weak often continue to lag behind. Until the dance ends; then the created power quickly collapses.

"Low Float Theory" (MingXMecca):

Think about incentive measures, some projects have huge unpaid floating capital / in the future, hedging can be done. Let the market makers intentionally raise it, so that traders think they should join this 'narrative' - allocation; instead of selling at a price of 0 in a deep bear market later. They have been waiting for the echo of GCR.

Reverse Supercycle (MingXMecca):

Web3 has not seen any real change, people are just talking about their narratives at the top and bottom. I have always told people that the idea that all Tokens will go to zero is just the reverse of Supercycle, "this time it's different". It's always the same game, and people love Tokens.

The best-performing Token has the worst Tokenomics:

Some of the best-performing Tokens have the worst Tokenomics, coming from the most predatory teams. Many teams launched at the peak of the Bear Market have been desperately waiting for more favorable conditions so that they can deploy their tactics and manipulate the market.

Winner takes all, loser gets nothing:

Try to imagine your Ponzi Scheme as a professional boxer instead of a Token; winner takes all, loser gets nothing. People really do cut their winning combinations and increase their losing combinations instead of seeking treatment.

Increase risk at the beginning of the AltCoin cycle:

We observe the general trading principles when MEME coin rises: during the AltCoin cycle, you should increase risk when the trend reverses for the first time, and gradually protect capital over time. People lose money because their approach is exactly the opposite; slow in the early stages, and increasingly greedy over time.

I continue to hold a large position in Spot BTC and ETH because I believe we have bottomed out in November and remain optimistic about the future; aiming to achieve the target of $10,000 ETH by 2030. 90% of holders will be better off. This advice only applies to Degen traders playing with garbage coins.

The best indicator to know how much juice is left in an altcoin season:

Long has been trading in the altcoin season for a long time. One of the best indicators of remaining long juice is how AltCoins react to news, announcements, listings, and fraud. When the altcoin season is about to rug, traders are still going long on the news, but will immediately start dumping.

HODL Spot:

I bought about 16,000-18,000 Tokens in 2022, and I am not very interested in long trades. I plan to sell them to institutions/TradFi funds in the late stage of the next cycle. I have expanded the scale of some reverse investments and selected some narrative/rotation-exhausted selected junk coins.

Research 2019 and 2020:

Don't expect too much. The entire banking system will not collapse overnight, nor will it overnight lead to hyper-bitcoinization and push BTC to rise to $1 million. Don't expect too little either; when we get a correction, it's not CZ designed eyewash for exiting Liquidity, it's going back to zero. Stay balanced. Study 2019 and 2020.

ETH will reach $10,000 one day:

This may be my last tweet about Cryptocurrency. As I often say, if you have long-term faith in BTC and ETH, you just need to hold them without trading, and you will have a good return. They will only continue to print more long money; you are unlikely to catch every local move. ETH will reach $10,000 one day.

Disclaimer: Readers are strictly required to comply with local laws and regulations. The above content does not constitute any investment advice.

- Reward

- like

- Comment

- Share

August may become the major turning point for the encryption market

This is something I have been discussing openly for some time, but today I want to reconfirm that evidence suggests that there may be significant trends and emotional changes in the BTC and broader cryptocurrency market between August 6th and 12th.

A few months ago, I mentioned this time period for the first time in the video outlook, which you can find here.

Today, I will show all the evidence gradually established based on the time range, price range, and time perspective. I think you will see a high probability of significant events or news occurring within this time window.

We will start from the monthly chart and go all the way to the daily chart to show the convergence of multiple factors we see.

The monthly chart is the content we focused on following last week, but to further prove that we are in the same cycle, we have also included the months of the previous two tops. As you can see, the previous two cycles are almost identical to the current cycle. The 33 months from the major high point and the 20 months from the major low point both place us in the timeframe from July to September, which is the last low point before a significant pump.

Now we know that time is on our side, but many people believe that this cycle is different because prices have quickly reached new all-time highs. However, let's compare the current cycle with previous cycles on the monthly chart.

The evidence is quite shocking. As you can see, except for 2012, in the first two cycles, the price pumped just over 200% from the Bear Market low, which is exactly where we are now. As you can see, this time is no different. In fact, time and price are where they should be, neither overextended as some commentators have said, nor exceeding expectations.

Next, let's look at the weekly chart, and there is more long content to discuss. First of all, we found that there will be a major trend change every 30 weeks in this cycle. Interestingly, this 30-week cycle falls exactly between a major low and a major high, and they occur simultaneously. I will explain the reason in the next few charts, but for now, the next 30-week cycle falls exactly on the week of August 12th. These three 30-week cycles add up to a total of 90 weeks from the Bear Market low point.

Now, based on our evidence, this market is in a different stage, in my opinion, inflection point is more likely to occur in the form of a major low rather than a major high. But as I have always said, in these cycles, we often see a major high and low in this time window at the same time.

The chart below shows this particular period in each cycle and the situation at the same time last year in this cycle. As you can see, there is almost always a sharp pump in August, followed by a rapid decline, with a drop of up to 20-50%. Last year, it was different from the other three charts as it was only in the second year of the cycle, but it showed the seasonal characteristic of this type of trend occurring in August.

It also demonstrates that significant highs and lows occurred near the turning point of the market in a 30-week cycle, with a relatively tight time window.

Now let's take a look from a time perspective. Simply put, the time perspective refers to starting from a significant high or low point and calculating 30 calendar days, and looking for trend changes. You just need to start with 30, and then add 30, 60, 90, 120, 150, 180, and so on, and look for trend changes at these time points. The more concentrated the time points, the higher the importance of that day or week.

As shown in the chart below, all these time measurements fall within a time angle window. In this cycle, we have several major highs and lows that point to the second week of August as a major convergence period.

Finally, from the perspective of the time range, the market has always followed a cycle of 150 days in this cycle: 155 days of pump and 150 days of consolidation. It is worth noting that the balance of market time should not be imbalanced. That is to say, the number of days the market falls should not exceed the number of days of pump. In a Bull Market, the time of market pump is usually longer than the time of decline, as shown in the chart below. If the number of days the market falls exceeds the previous 150 days and new lows appear, this will not be a good sign.

Finally, taking into account the price range, time frame, timing, and seasonal factors, we are approaching a mid-August window that is very likely to become a trigger point for BTC. If this evidence is not sufficient, please note that the start date of the BTC chart is August 19th. I won't dwell too much on this issue, but the birth date is important, and August is typically the start of a major bull market.

This is why I remain cautious here and wait for the end of this window before taking more aggressive action. Will we see ETH ETF finally begin trading, followed by a rapid decline like BTC ETF? Or will we see more uncertainty caused by long political headlines leading up to the election? I'm not entirely sure what it will be, but it's definitely a period worth following and being patient with.

- Reward

- like

- 1

- Share

Trump Will Speak Today: Here Are the Possibilities That Could Change Bitcoin's Fate! - Koin Bulletin

US presidential candidate Donald Trump will speak at the Bitcoin 2024 conference today at 21:00 GMT.

The big day has finally arrived for Donald Trump to talk about Bitcoin. Important figures have attended the Bitcoin 2024 conference, which started two days ago in Nashville, USA. However, the Trump effect is expected to be much stronger.

It is believed that the most important statement in Donald Trump's speech tonight at 21:00 GMT+3, which could skyrocket the price, will be the words "We will include Bitcoin in the US reserve assets."

If Trump makes such a election promise and wins the race, he will have included Bitcoin in the reserves of the world's largest central bank, just like gold. This will significantly affect the reliability and popularity of Bitcoin globally.

Meanwhile, Trump previously stated that he wanted Bitcoin to be produced in the US. If he still holds this idea, he may also make a more specific incentive statement regarding Bitcoin mining.

Claims are diversifying, reserve expectations are increasing

Fred Thiel, CEO of Marathon Digital, a Bitcoin miner who will be speaking at the Bitcoin 2024 conference, made interesting predictions about Trump's speech.

Fred Thiel highlighted Trump's expectation regarding the reserve asset declaration, and in his statement, he included the following details:

If the US had a strategic reserve for Bitcoin, they could reflect their power. The US should be the largest Bitcoin owner and the largest Bitcoin miner.

Crypto currency researcher The Crypto Patriot says that Trump's support for US reserves with Bitcoin will also relieve the burden on the dollar, and said in his statement:

I hope that Trump will support our reserves with Bitcoin and I think this will provide some stability to the dollar. The dollar is currently under attack and the rest of the world understands what we are doing. If we can support it with Bitcoin and bring back the standard that cannot be inflated for the dollar, I think this will be a great success.

- Reward

- like

- Comment

- Share

- Topic

- Pin

- 🔥 Join "Suggested Topics" Campaign & Win Weekly Points Rewards

How to join:

1.Visit Gate Post APP page

2.Click any top 3 "Suggested Topics"

3.Users who post quality content under "Suggested Topics" will be selected to win rewards.

🎁 Lucky winners will receive $20 Points each

More: https://www.gate.io/article/33633

- 📢Gate.io trading robot community ambassador benefits upgrade!

📝 Easy tasks, happy points winning!

Achieve the required points to receive rewards on a monthly basis!

💰Individuals can receive up to 100 USDT per month!

If you: 👇

Familiar with trading robots and their operation mechanisms.

Frequently active in different communities. Have community management experience.

🚀 Immediately private message the administrator (https://t.me/Gate_CopyTrading) to sign up and win rewards!

- 🫵 We want you, Crypto Observer!

🎉 Become a Gate.io Post Crypto Observer & Win Daily Great Rewards!

🌟 How to join?

1.Share daily crypto news, market trends, and insights into your post.

2.Include the #CryptoObservers# to successfully participate.

🎁 5 lucky "Crypto Observers" will be rewarded $2 token rewards each weekday!

📌 The winners list will be announced daily, and rewards will be distributed together next week.

⏰ Ends at 16:00 July 31 UTC

- 🎁Attention! A Gate.io grand prize is waiting for you!

➡️ Vote for your favorite content creators and streamers!

🎁 Win a MacBook Air and exclusive merch!

📅 Jul 8 - Aug 4 (UTC)

🗳️Vote Now: https://gate.io/activities/community-gala

More: https://gate.io/announcements/article/37717

- 📢 #Gateio # WCTCS6 is NOW OPEN for official registration!

🔗 Don’t miss out – 📅 Register now from today until August 12!

🔥 Get ready for an array of exciting events: Team Competition, 1v1 Battle Blitz, Gift Bonanza, Live Lucky Draws, and more!

🎁 Win an iPhone, VIP Tier+1, Gate merch, and more – with a prize pool that can expand up to $5 MILLION!

- About

- Products