奔跑财经

Trading Bots

Block This User

Post

Live

奔跑财经

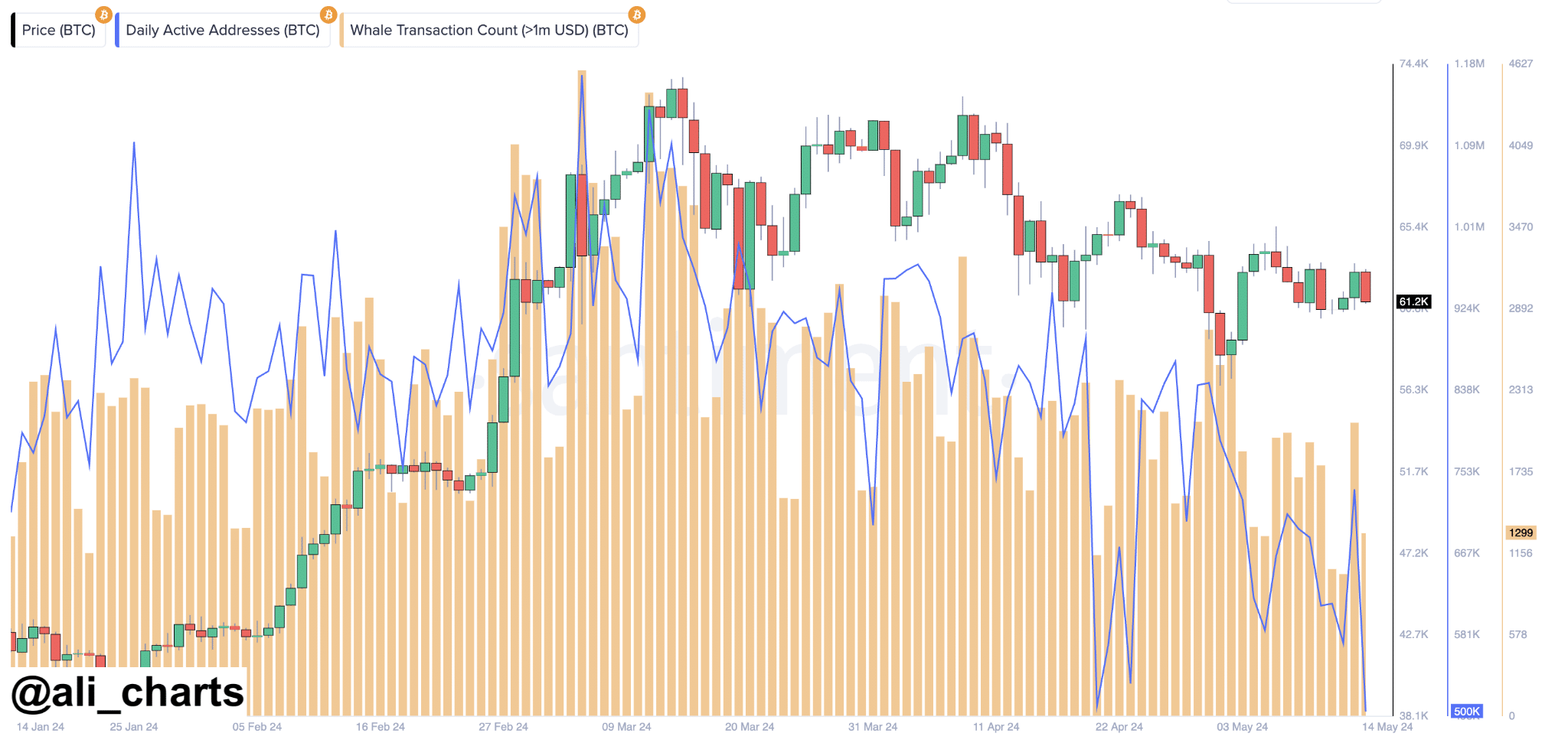

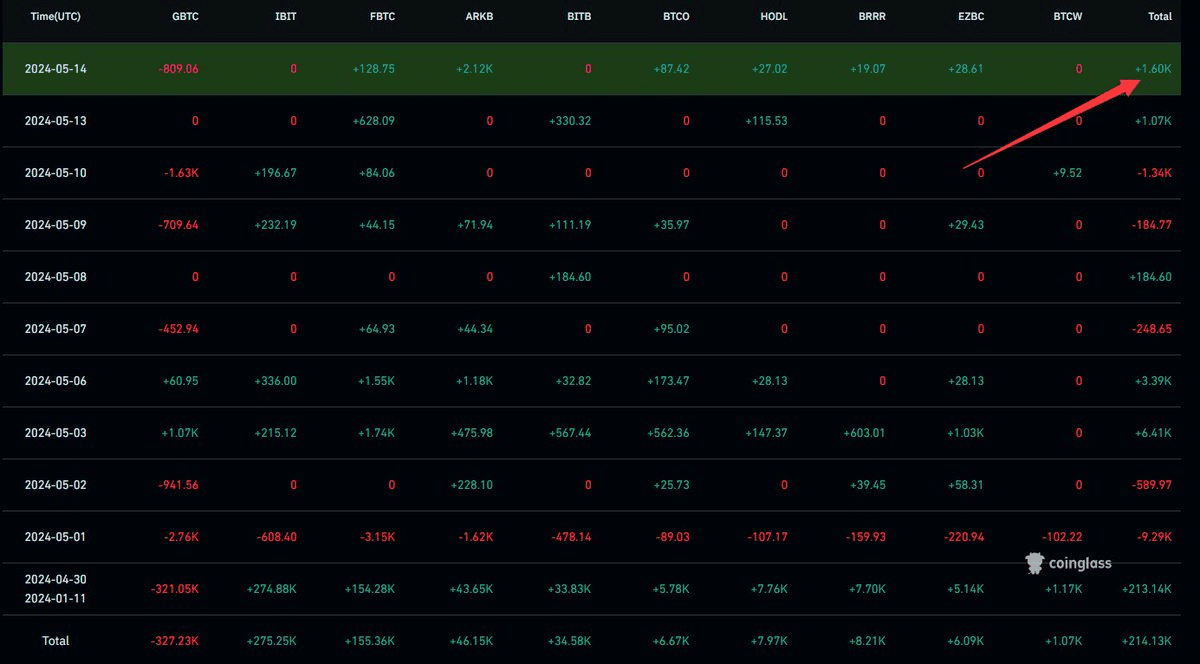

Bitcoin ETF: Institutional whales are buying aggressively, while retail investors remain cautious.

Institutional investors are playing a key role in the Bitcoin ETF field, leading to significant changes in the cryptocurrency market. Meanwhile, retail investors are choosing to remain cautious. IntotheBlock‘s report shows a divided market landscape, with hedge funds and pension funds increasing their holdings of Bitcoin through ETFs, while regular investors continue to maintain a cautious attitude.

Institutional investors launch Bitcoin ETF

In early 2024, the listing of Bitcoin Exchange Traded Funds (ETFs) on the New York Stock Exchange marked an important turning point, paving the way for institutional investors to pour their funds into the cryptocurrency market. At the same time, this development is a blessing for investors who hold a large amount of Bitcoin, also known as "Bitcoin whales," as they can use these emerging financial tools to buy a large amount of such crypto assets.

IntotheBlock‘s data shows that these Whales

Institutional investors launch Bitcoin ETF

In early 2024, the listing of Bitcoin Exchange Traded Funds (ETFs) on the New York Stock Exchange marked an important turning point, paving the way for institutional investors to pour their funds into the cryptocurrency market. At the same time, this development is a blessing for investors who hold a large amount of Bitcoin, also known as "Bitcoin whales," as they can use these emerging financial tools to buy a large amount of such crypto assets.

IntotheBlock‘s data shows that these Whales

View Original

1 Likes

- Reward

- 1

- 1

- Share

GateUser-6198a4c3 :

:

ETF has a significant impact on the crypto world, especially BTC and Ethereum.This week, the volatility is expected to remain stable, and the cryptocurrency market is waiting for the direction of the US economy.

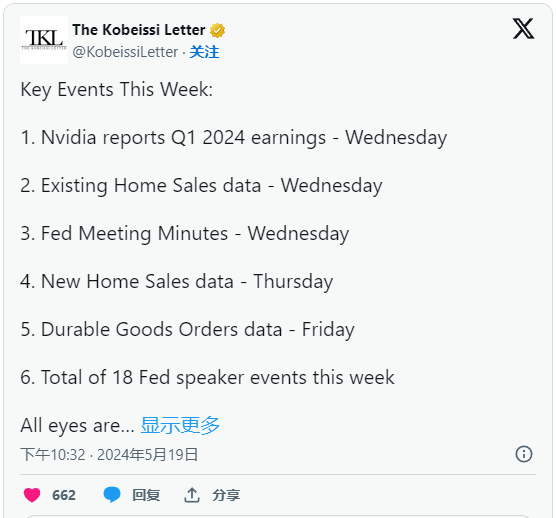

The United States economic agenda will once again face a busy week, and the cryptocurrency market has resumed a consolidation trend. Will the volatility increase this week?

This week‘s economic highlights are the Federal Reserve meeting minutes and the important earnings report from semiconductor giant Nvidia.

There are also reports on global manufacturing and services indices, as well as consumer inflation expectations, which may have certain impacts on the market.

May 20th to 24th economic schedule

Last week, the Dow Jones Industrial Average (DJIA) broke through the 40,000-point barrier for the first time. The stock market was boosted by favorable figures in the CPI report, which sparked speculation about a cooling US economy and possible interest rate cuts by the Central Bank in the coming months.

This Wednesday, the market will welcome the Federal Open Market Committee (FOMC) meeting.

This week‘s economic highlights are the Federal Reserve meeting minutes and the important earnings report from semiconductor giant Nvidia.

There are also reports on global manufacturing and services indices, as well as consumer inflation expectations, which may have certain impacts on the market.

May 20th to 24th economic schedule

Last week, the Dow Jones Industrial Average (DJIA) broke through the 40,000-point barrier for the first time. The stock market was boosted by favorable figures in the CPI report, which sparked speculation about a cooling US economy and possible interest rate cuts by the Central Bank in the coming months.

This Wednesday, the market will welcome the Federal Open Market Committee (FOMC) meeting.

- Reward

- like

- Comment

- Share

DOGE is expected to be integrated into X payments, and its future depends on Musk and regulatory trends.

A source revealed that Dogecoin (DOGE) is expected to be integrated into Elon Musk‘s X (also known as "Twitter") payment platform, which has sparked excited discussions in the Dogecoin community. However, before Dogecoin truly takes off, we need to examine this situation more closely.

Dogecoin believers are excited about the tweets from insiders.

"DogeDesigner", an insider with connections to both X Official and Dogecoin, caused a wave of excitement in the Dogecoin community with a tweet suggesting that X Pay may support Dogecoin by the end of 2024. This hint has sparked enthusiasm among cryptocurrency enthusiasts and regular users, who are eagerly looking forward to seeing Dogecoin take a prominent position on this popular platform.

Musk remains silent: Can Dogecoin usher in X

Dogecoin believers are excited about the tweets from insiders.

"DogeDesigner", an insider with connections to both X Official and Dogecoin, caused a wave of excitement in the Dogecoin community with a tweet suggesting that X Pay may support Dogecoin by the end of 2024. This hint has sparked enthusiasm among cryptocurrency enthusiasts and regular users, who are eagerly looking forward to seeing Dogecoin take a prominent position on this popular platform.

Musk remains silent: Can Dogecoin usher in X

View Original

- Reward

- like

- Comment

- Share

Venezuela cuts off power to crypto mining farms to enhance grid security and crack down on illegal mining.

Summary:

• Venezuela will cut off power to all cryptocurrency mining farms in the national power system.

• Power cuts are carried out by the authorities due to excessive energy consumption and blackouts.

• This measure mainly targets miners who do not pay electricity bills.

• Venezuela will cut off power to all cryptocurrency mining farms in the national power system.

• Power cuts are carried out by the authorities due to excessive energy consumption and blackouts.

• This measure mainly targets miners who do not pay electricity bills.

- Reward

- like

- Comment

- Share

Genesis has been approved by the court to return $3 billion to creditors.

Given the massive debt and numerous claims from creditors, equity holders like DCG have no possibility of remaining assets.

The bankrupt encryption lending company Genesis Global Holdco received court approval last Friday as part of the bankruptcy liquidation process to return approximately $3 billion in cash and encrypted assets to its creditors. This decision was made by US bankruptcy judge Sean Lane.

In addition, Judge Sean

The bankrupt encryption lending company Genesis Global Holdco received court approval last Friday as part of the bankruptcy liquidation process to return approximately $3 billion in cash and encrypted assets to its creditors. This decision was made by US bankruptcy judge Sean Lane.

In addition, Judge Sean

- Reward

- like

- 2

- Share

Psicopi :

:

Keep BUIDL🧐Psicopi :

:

WAGMI 💪Hong Kong police arrested an employee of a cryptocurrency on suspicion of fraud!

Three employees of a Tsim Sha Tsui cryptocurrency have been detained on suspicion of defrauding a customer with counterfeit virtual currency.

Hong Kong police have detained three employees of an suspected of engaging in fraudulent activities.

Previously, a customer at the store reported encountering "hell money" when executing a cryptocurrency transfer worth about 1 million Hong Kong dollars.

Hong Kong authorities arrest 3 people on suspicion of cryptocurrency fraud.

On Wednesday, the Hong Kong Police‘s Technology Crime Division arrested three individuals aged between 31 and 34. Authorities seized 3000 Hell Money, a safe, and a money counter from a shop in Tsim Sha Tsui. Hell Money, which is traditionally used to honor ancestors or deities in Chinese rituals, was also confiscated.

The arrest operation took place after a 35-year-old man reported on April 12th. The man claimed that he sold approximately 1 million Hong Kong dollars worth of Tether (USDT) at a shop in Tsim Sha Tsui, but was unable to withdraw the cash.

Hong Kong police have detained three employees of an suspected of engaging in fraudulent activities.

Previously, a customer at the store reported encountering "hell money" when executing a cryptocurrency transfer worth about 1 million Hong Kong dollars.

Hong Kong authorities arrest 3 people on suspicion of cryptocurrency fraud.

On Wednesday, the Hong Kong Police‘s Technology Crime Division arrested three individuals aged between 31 and 34. Authorities seized 3000 Hell Money, a safe, and a money counter from a shop in Tsim Sha Tsui. Hell Money, which is traditionally used to honor ancestors or deities in Chinese rituals, was also confiscated.

The arrest operation took place after a 35-year-old man reported on April 12th. The man claimed that he sold approximately 1 million Hong Kong dollars worth of Tether (USDT) at a shop in Tsim Sha Tsui, but was unable to withdraw the cash.

View Original

- Reward

- like

- Comment

- Share

Chinese police raid illegal underground banking business involving 1.9 billion USDT.

The suspect is suspected of using USDT to operate forex payment and settlement businesses, providing illegal services to smugglers of cosmetics and drugs.

Chinese police have busted an underground banking operation that used the popular stablecoin Tether (USDT) to facilitate transfers worth up to 13.8 billion yuan ($1.9 billion).

According to the report from the local media WeChat public account, the Chengdu Public Security Department has arrested 193 suspects related to this case and frozen 149 million yuan (20.6 million US dollars), previously raided the location of this operation.

$1.9 billion underground banking business

Since 2021, the investigation conducted by the police has revealed that this underground banking operation is led by a criminal gang that originated from China‘s import and export business. They use USDT to operate forex payments and settlement services, providing illegal services to cosmetics and drug smugglers, as well as locals seeking foreign assets.

Chinese police have busted an underground banking operation that used the popular stablecoin Tether (USDT) to facilitate transfers worth up to 13.8 billion yuan ($1.9 billion).

According to the report from the local media WeChat public account, the Chengdu Public Security Department has arrested 193 suspects related to this case and frozen 149 million yuan (20.6 million US dollars), previously raided the location of this operation.

$1.9 billion underground banking business

Since 2021, the investigation conducted by the police has revealed that this underground banking operation is led by a criminal gang that originated from China‘s import and export business. They use USDT to operate forex payments and settlement services, providing illegal services to cosmetics and drug smugglers, as well as locals seeking foreign assets.

View Original

- Reward

- like

- 5

- Share

GateUser-98705c8d :

:

19.8 billion found / how much they really have in euros. It is not known, it is currently a lot since Biden border fraudGateUser-98705c8d :

:

lol 1.9mrd frohen - it remember me to USA who froze Putin moneyView More

Two Chinese citizens have been arrested in a $73 million "Ponzi scheme" cryptocurrency fraud case.

摘要:Summary:

• The US Department of Justice has arrested two Chinese citizens who are suspected of being involved in an international cryptocurrency fraud case involving $73 million.

• This scam is called "杀猪盘" in Chinese, and it involves money laundering through shell companies.

• The case highlights the growing scrutiny of "pig slaughter" schemes involving Crypto Assets.

The U.S. Department of Justice (DOJ) arrested two Chinese citizens, Daren Li and Yicheng Zhang, for orchestrating a massive Crypto Assets scam known as the "Pig Killing Plate," which involved at least 7,300 people

• The US Department of Justice has arrested two Chinese citizens who are suspected of being involved in an international cryptocurrency fraud case involving $73 million.

• This scam is called "杀猪盘" in Chinese, and it involves money laundering through shell companies.

• The case highlights the growing scrutiny of "pig slaughter" schemes involving Crypto Assets.

The U.S. Department of Justice (DOJ) arrested two Chinese citizens, Daren Li and Yicheng Zhang, for orchestrating a massive Crypto Assets scam known as the "Pig Killing Plate," which involved at least 7,300 people

View Original

- Reward

- like

- 5

- Share

GateUser-0151cfab :

:

Boss, take me with you 💰PleaseTakeCareOfThe :

:

Big brother, guide me 💰View More

Hong Kong allows the use of digital RMB for local business, with restrictions on cross-border usage.

Summary:

• The Hong Kong Monetary Authority (HKMA) has approved the retail use of digital RMB coins (e-CNY) in Hong Kong, but not for cross-border transactions.

• The adoption of digital RMB in Hong Kong is subject to control and monitoring, with transaction and balance restrictions.

• Hong Kong has approved pilot projects endorsed by China to promote the development of digital renminbi and improve the digital money ecosystem in Asia.

• The Hong Kong Monetary Authority (HKMA) has approved the retail use of digital RMB coins (e-CNY) in Hong Kong, but not for cross-border transactions.

• The adoption of digital RMB in Hong Kong is subject to control and monitoring, with transaction and balance restrictions.

• Hong Kong has approved pilot projects endorsed by China to promote the development of digital renminbi and improve the digital money ecosystem in Asia.

- Reward

- like

- 1

- Share

NJM28 :

:

WAGMI 💪On-chain Future: The Dual Play of Enterprise Blockchain Revolution and Mining Policy

With the deepening of digital transformation, blockchain technology is gradually becoming an indispensable part of enterprise operations. By providing a decentralized and tamper-proof data recording method, it greatly improves the operational efficiency and data security of enterprises. The introduction of blockchain technology can not only optimize supply chain management and reduce transaction costs, but also enhance the transparency and trust of enterprises, bringing unprecedented potential for transformation to enterprises.

Meanwhile, changes in mining policies have also had a profound impact on the global cryptocurrency market. As an important component of the cryptocurrency ecosystem, the stability of the policy environment directly affects the output and price of cryptocurrencies. In recent years, with increasing concerns about environmental issues, some countries have started to impose restrictions on energy-intensive mining activities. This not only affects the operation of mining companies but also to some extent affects the supply and demand relationship in the cryptocurrency market.

In this article

Meanwhile, changes in mining policies have also had a profound impact on the global cryptocurrency market. As an important component of the cryptocurrency ecosystem, the stability of the policy environment directly affects the output and price of cryptocurrencies. In recent years, with increasing concerns about environmental issues, some countries have started to impose restrictions on energy-intensive mining activities. This not only affects the operation of mining companies but also to some extent affects the supply and demand relationship in the cryptocurrency market.

In this article

- Reward

- like

- Comment

- Share

Today‘s crypto world information summary | Bitcoin prices recovered slightly, but market participants were cautious

As the digital money market continues to evolve, we have witnessed a significant recent rebound in Bitcoin prices, a change that has attracted a lot of attention from investors around the world. As of May 17, Bitcoin not only achieved a bottoming Rebound, but also achieved an 8.4% pump in just two days, hitting a nearly three-week high of $66,750 at one point.

Despite the boost in market sentiment, traders remained cautious and did not rush to forecast the pump. At the same time, venture capital activity in the Crypto Assets space is also active, industry cooperation and innovation are emerging, and legal regulation of Crypto Assets has also become the focus of market participants.

In this context, the cautious attitude of market participants contrasts sharply with the innovative development of the industry, which together shape the future direction of the digital money market. Next, this article will bring you a summary of the latest news trends in the crypto world on May 17.

|

Despite the boost in market sentiment, traders remained cautious and did not rush to forecast the pump. At the same time, venture capital activity in the Crypto Assets space is also active, industry cooperation and innovation are emerging, and legal regulation of Crypto Assets has also become the focus of market participants.

In this context, the cautious attitude of market participants contrasts sharply with the innovative development of the industry, which together shape the future direction of the digital money market. Next, this article will bring you a summary of the latest news trends in the crypto world on May 17.

|

View Original

- Reward

- like

- Comment

- Share

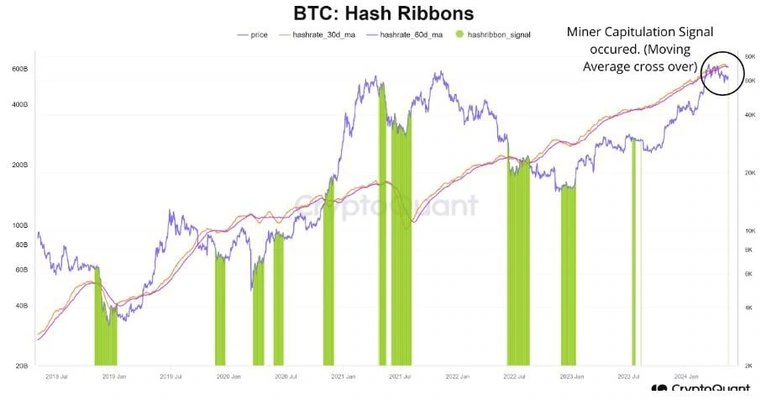

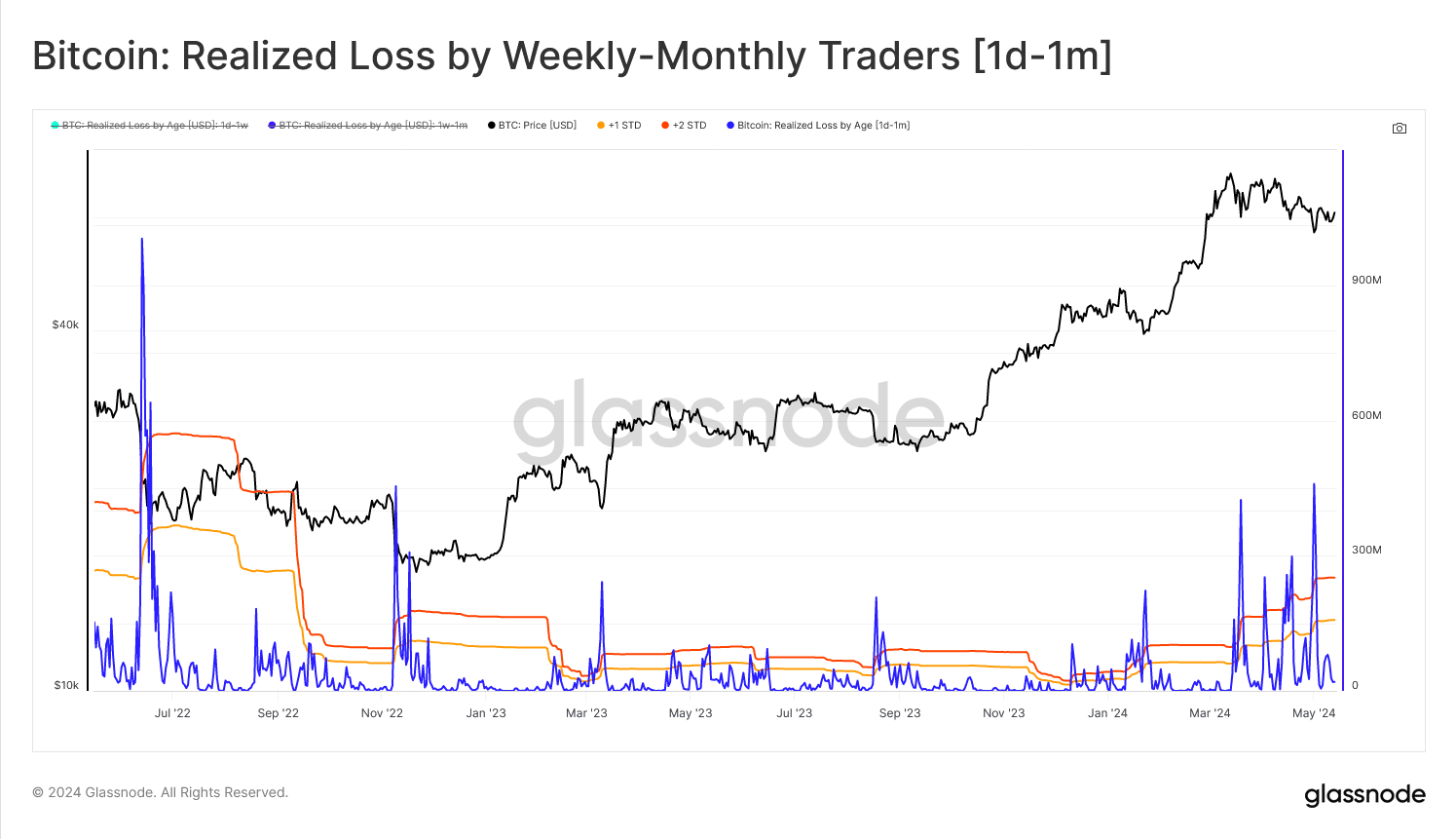

Miner dilemma: Bitcoin hashrate is declining Miner facing a profit test

Bitcoin Nearly a month after the fourth Bitcoin Halving incident, the first signs of a decrease in Miner revenue are slowly emerging, and one of the obvious indicators is the decline in network hashrate.

The recent decline in this indicator may indicate the capitulation of miners, in which less efficient miners exit due to declining profitability.

The hash tape shows signs of capitulation

Earlier, hashrate‘s 30-day moving average peaked at 630 exabytes hash per second (EH/s), but has now fallen to 606

The recent decline in this indicator may indicate the capitulation of miners, in which less efficient miners exit due to declining profitability.

The hash tape shows signs of capitulation

Earlier, hashrate‘s 30-day moving average peaked at 630 exabytes hash per second (EH/s), but has now fallen to 606

- Reward

- like

- Comment

- Share

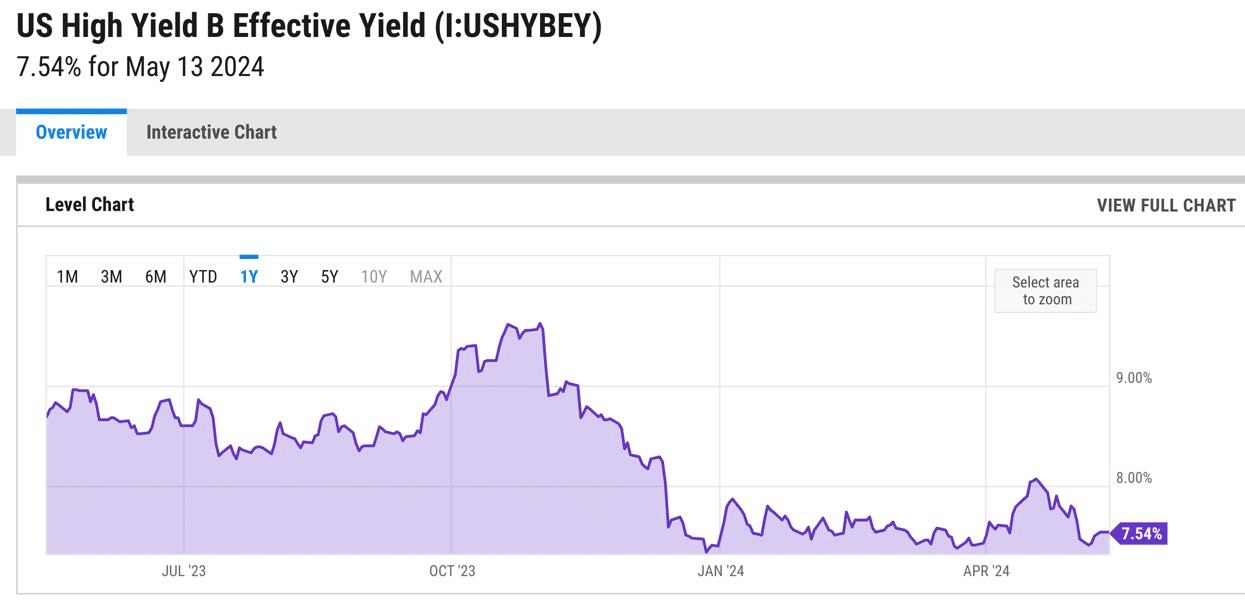

What Bitcoin Needs to Sustain Its All-Time High (ATH) in 2024

Brief Overview:

• For a sustainable rebound, Bitcoin needs the US high-yield Intrerest Rate to fall below 6% or below.

• Network activity is decreasing, and large investors are currently inactive.

Bitcoin (BTC) is still more than $10,000 below its all-time high reached earlier this year. The king of Crypto Assets struggled to hit the $67,000 mark, but so far, it has failed.

Popular financial analyst Timothy

• For a sustainable rebound, Bitcoin needs the US high-yield Intrerest Rate to fall below 6% or below.

• Network activity is decreasing, and large investors are currently inactive.

Bitcoin (BTC) is still more than $10,000 below its all-time high reached earlier this year. The king of Crypto Assets struggled to hit the $67,000 mark, but so far, it has failed.

Popular financial analyst Timothy

- Reward

- like

- Comment

- Share

Salva long extracted 474 Bitcoin from volcanic energy

Salva long has proven that Bitcoin can be mined not only by electricity, but also by using the geothermal energy of Mount Tekapa.

According to Reuters, the Salva long has successfully mined 473.5 Bitcoin over the past three years using the geothermal energy of Mount Tekapa. This mining activity added $29 million in Bitcoin value to the country, bringing its total Bitcoin holdings to 5,750, worth nearly $354 million.

According to the report, the 300 Bitcoin Mining processors currently in use in the Salva long are all powered by geothermal energy from Mount Tekapa. Of the 102 megawatts of electricity produced by the country‘s state-owned power plants, 1.5 is specifically allocated

According to Reuters, the Salva long has successfully mined 473.5 Bitcoin over the past three years using the geothermal energy of Mount Tekapa. This mining activity added $29 million in Bitcoin value to the country, bringing its total Bitcoin holdings to 5,750, worth nearly $354 million.

According to the report, the 300 Bitcoin Mining processors currently in use in the Salva long are all powered by geothermal energy from Mount Tekapa. Of the 102 megawatts of electricity produced by the country‘s state-owned power plants, 1.5 is specifically allocated

- Reward

- like

- Comment

- Share